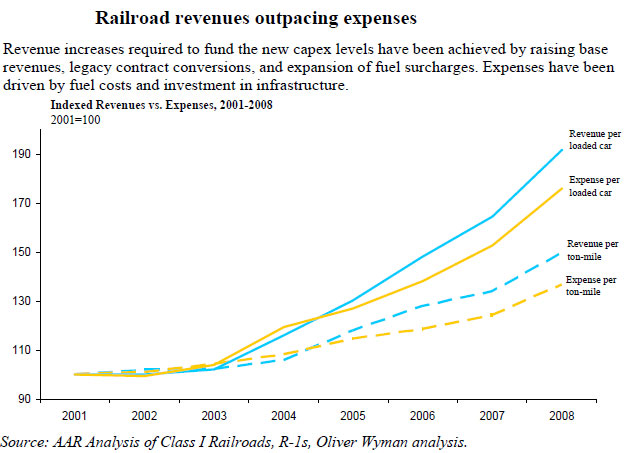

That improvement in operating ratios, in turn, is due to several factors: the relative ability of the rail carriers to hold prices (versus say the truckload carrier industry), more variable cost structures, and the rail carriers’ strong focus on productivity gains over the last 4-5 years, as shown in the figure below. As can be seen, starting in 2004, the growth in revenue per “ton-mile” has sharply outpaced the growth in costs per ton mile – and that spells profit.

“The rails have made very, very substantial productivity changes,” Rennicke said. “While the cost per unit, based on inflation, has gone up considerably, the number of units of input the rails required to produce the transportation services and products that they offer has fallen substantially.”

Part of this story is the fact that, slowly, the railroads have been outsourcing a growing variety of tasks, from engine maintenance to “weed and bush control.” The result is total cost structures that are now much more variable than they were 10 years ago, mitigating, in part, the impact of the lower freight volumes.

Rennicke says that improved car routing and scheduling is also an important part of the mix, as over the past decade all the major US railroads have implemented optimization software to produce those schedules. Prior to that, most of the scheduling was manually done.

At the same time, the rail carriers are continuing to invest in rail infrastructure – and, in many cases, also tapping into public money to add capacity. Total infrastructure spending by the railroads has really not dropped, according to Rennicke, even as the recession goes on. Why? While partially with an eye to the future and a return to growing volumes, the rails are also realizing the benefits of faster speeds.

Rennicke noted that several years ago, Union Pacific performed an analysis that showed that for every one mile per hour improvement in average train speed, a railroad can reduce its locomotives by 250, its freight cars by 5,000, and its train and engine employees by 150.

In addition, “Every one hour improvement in car terminal dwell is worth 2,500 freight cars, every day you can take out of your car cycle is worth 25,000 freight cars, and every one hour improvement in locomotive terminal dwell is worth 125 locomotives,” Rennicke said.

“For every 1% or 2% increase in overall average train speed, you’re able to take thousands of rail cars out of the system and also reduce the various expenses that are associated with those leases,” he added.

No matter how you look at it, the carriers have clearly seen that there is a “better way to run a railroad” – which ultimately will benefit both shippers and investors.

Any of the news here about the US rail industry surprise you? Do you expect rail volumes to jump back any time soon? Are shippers really seeing the benefits of the railroad operating improvements? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest