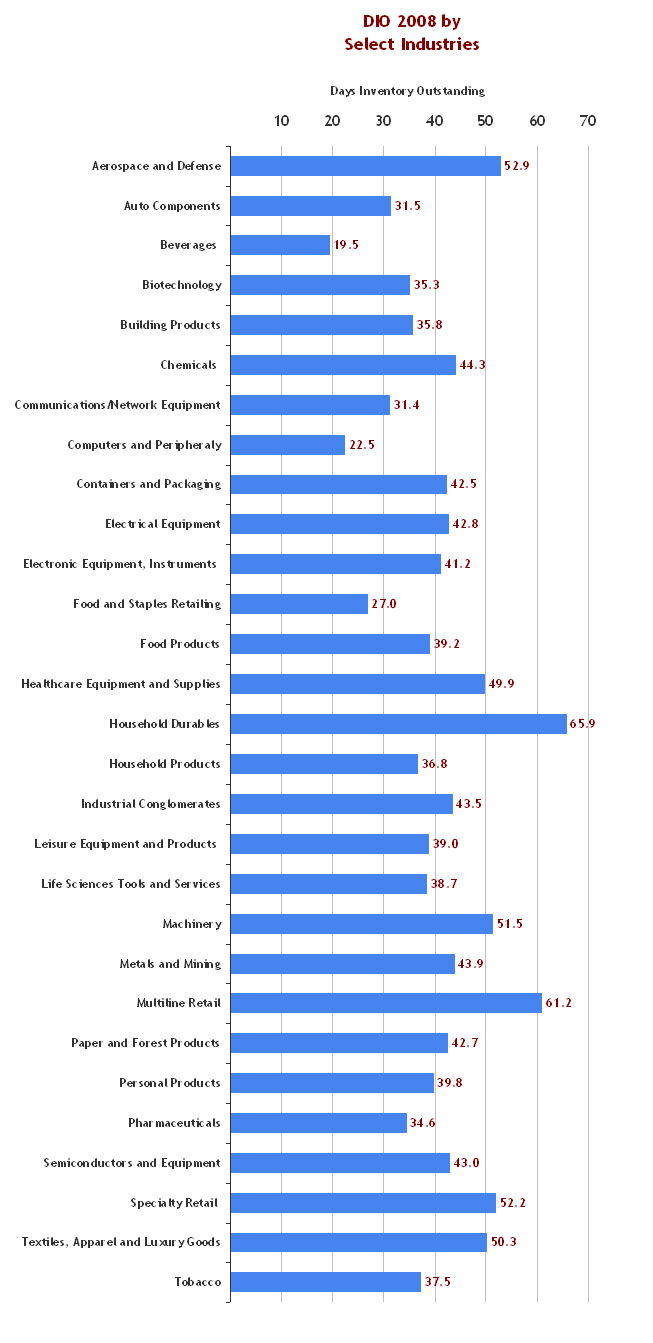

Below we have charted the DIO, using the CFO formula, for select industries, focusing only on those that have a physical product supply chain, as opposed to banking and other non-physical product service sectors.

Changes Across Sectors

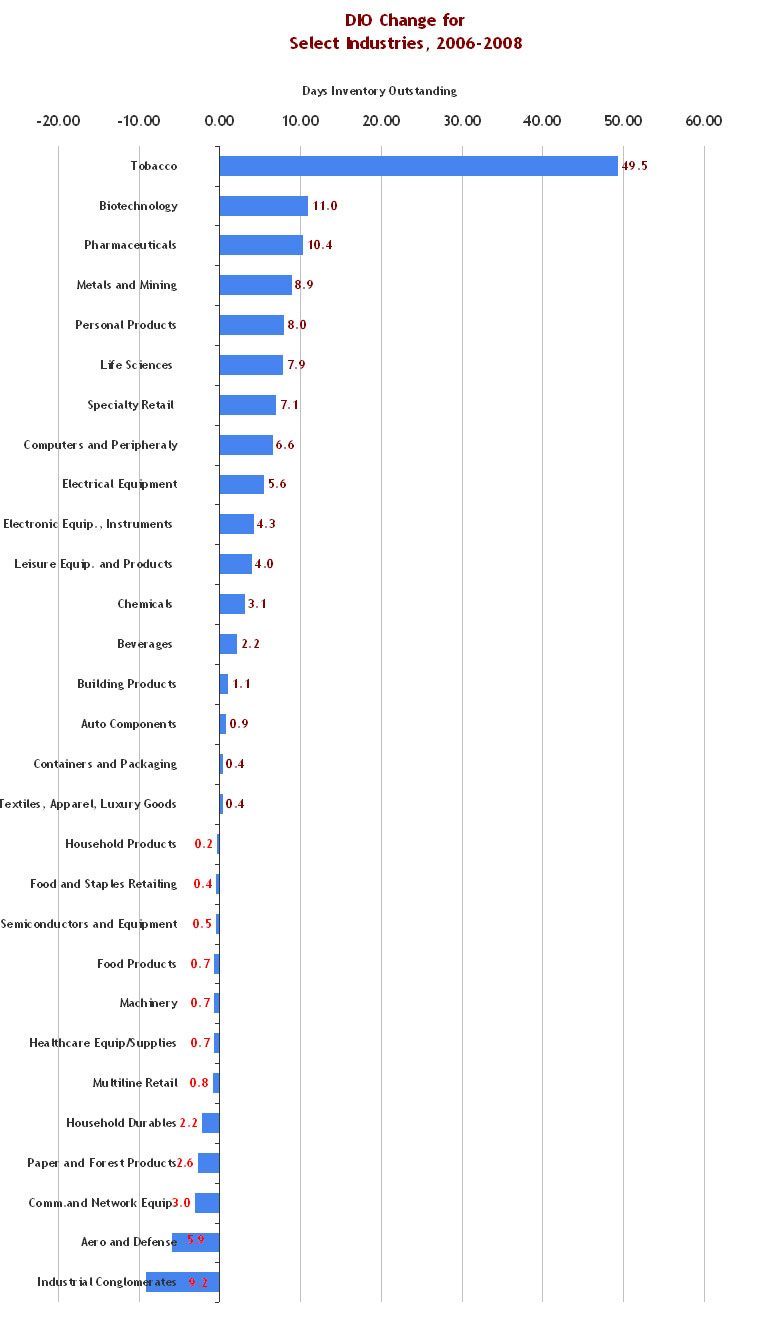

We also thought it would be interesting to look at changes in DIO over the past three years, as charted below. The change was calculated by subtracting the 2008 number from the 2006 number. Therefore, positive numbers are good (lower DIO), and negative numbers indicate declining performance.

The tobacco industry number is an outlier, as in a sector with a relatively few number of companies, a major improvement by one company, Altria, really moved the median number lower between 2006 and 2008.

It stands out to us that companies in the medical/pharmaceutical/personal care industries seem to have put a great emphasis on inventory management, as several sectors in that area are near the top of the improvement list. The Biotech sector (e.g., Amgen, Gilead) was especially impressive, as the approximate decrease in DIO by 11 days represents about a 25% improvement over the two years.

Specialty retail, which includes a wide range of types of retailers that, as a group, was known as often having perhaps excessive inventory levels, made great strides as well, moving from a DIO of about 59 in 2006 to around 52 in 2008, for an improvement of 12%.

We were surprised, in a sense, that consumer packaged/household products, food manufacturing, and broad line retail (mass merchants and department stores), were all in slightly negative over that period.

Those are the numbers. You can compare the change in the second chart to the 2008 numbers in the first chart to get a sense of percentage changes as well.

Any reaction to the 2008 inventory numbers? Was 2008 such a strange year that it is hard to really draw strong conclusions around inventory management trends? What do you think the 2009 numbers will show? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |