- Flow Wave: The increasing pace and ease in which knowledge, capital and talent move across a company and across the globe. How well a company manages its knowledge flows will be a critical determinant of its short and long-term success, especially in this age of extreme volatility.

- Impact Wave: The business impact of the first two changes, in terms of a variety of macro statistics around overall corporate financial performance and the competitive environment.

The report contains some 135 pages of data and comment, and is available from its own Big Shift web site: Deloitte 2009 Shift Index report download.

Below, we summarize some of the key data and conclusions that are likely to be of highest interest to supply chain professionals.

- Today’s digital technologies are being adopted at rates 2-5 times faster than previous “infrastructure” shifts, such as electricity and telephones.

- The increase market and environmental volatility, combined with the increase in competitive intensity, has led to a doubling of what Deloitte calls the “topple rate,” or the pace at which top companies in a sector lose their leadership positions.

- The gap in ROA performance among firms – a key overall corporate and supply chain metric, continues to expand. “Winners” are barely keeping their ROA rates stable, while “losers” see rapid deterioration in performance. Rightly or wrongly, such ROA pressure is a key factor in many outsourcing decisions, as companies seek to shed fixed costs and assets.

- Relatedly, an increasing share of economic growth is going to “talent,” rather than “assets.”

- In the past, “stocks” of knowledge – such as proprietary manufacturing processes, were critical for success. Now, “flows of knowledge” within a corporation and its partners are becoming a key success determinant. It cites SAP, for example, as having 1.5 million participants in its developer network; most are non-SAP employees. A member posting a question gets a response in an average of 17 minutes, and 85% of questions are ultimately flagged as “resolved.” The goal of “scalable efficiency” that companies have sought in the past needs to be complemented by “scalable learning.”

- Innovation, more than ever, is likely to come from the bottom up, not the top down, and integrated with “social media” and other input from customers or potential customers.

- Despite various protests against “globalization” from many quarters, concerns amplified during the recession, overall economic freedom and liberalization have continued to grow at a substantial pace this decade, accelerating world trade volumes.

- There is a trend towards migration of people to “creative” cities, which may, in part, reverse the overall US trend of movement of population from North to South, and East to West. While, overall, that trend is continuing, “creative” cities such as Boston, Minneapolis, and Washington-Baltimore are also benefitting.

- “Interaction costs,” especially among businesses, are plummeting, based on digital advances.

- Power is increasingly shifting from companies to customers.

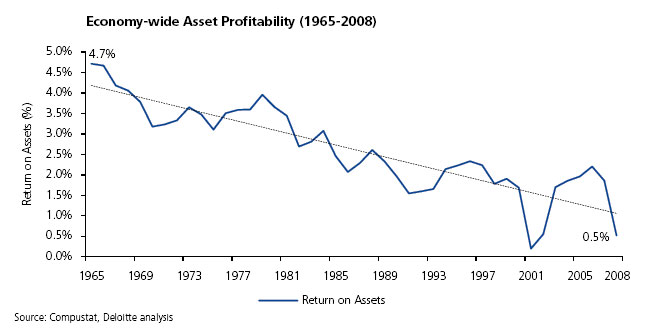

The increase in competitive intensity and the increasing power of customers are the key factors behind the remarkable decrease in ROA performance by corporations, illustrated in the graphic below.

As we noted last week, these ROA declines come during a period both characterized by substantial productivity gains and a significant decrease in the effective tax rates on US corporations (about a 12% decline), both of which should serve to increase ROA.

How can this profitability trend be reversed?

Deloitte says it will “require a profound shift in thinking and a strong grasp of the forces – often overlooked – facing modern firms.”

In particular, Deloitte says, “executives will have to focus on capability leverage mobilizing the resources of others to deliver more value (the numerator in the profitability ratio), rather than just cost reduction a driver of firm profitability.”

That last comment certainly sounds like “channel masters” organizing to compete on a supply chain-to-supply chain basis.

In the end, we’re not sure that the quantification of the three waves into indices really adds a lot of insight – it is hard to really understand what the “slope” of the index line graphs really tell us.

That said, that we are in a new world that is changing faster than many of us realize, and in ways most executives don’t understand or have much experience with, is made clear in this report.

And if businesses must change, their supply chains must evolve along with them. Digitization, knowledge flows, collaboration, and rapid response capability will certainly be fundamental to those efforts.

Any reaction to the Deloitte report? Are we in a “Big Shift?” What are the most important “waves,” and how will they impact supply chains? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |