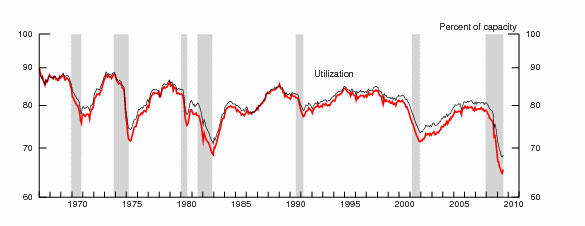

In fact, despite the 14.5% drop in output since July 2008, the US has seen manufacturing capacity decline a mere .5% in that time. As shown in the chart below, that means, of course, that factory utilization in the US has also taken a tremendous hit.

US Factory Utilization

Manufacturing capacity utilization also increased slightly in July, up .7%. But that left it still at just 65.4%, versus 76.1% in July 2008, for a drop of 10.7 percentage points in a year.

This recession has led to the worst factory utilization numbers since the Great Depression. In the 2001-2002 recession, for example, the worst level US factory utilization reached was 71.4%. In the very severe recession of 1981, capacity utilization fell only to levels in the upper 60 percent range.

Low factory utilization, of course, causes the US manufacturing sector and individual producers all kinds of problems, besides just the loss in sales volumes. Factory overhead as a percent of sales rises, adding another hit to the bottom line. Factories with much idle capacity have little or no pricing power, often causing prices to fall – and indeed, in July, wholesale prices in the US fell .9%. The excess capacity also means manufacturers need much less investment in new plant or equipment, so that adds a further drag on the economy.

Still, the modest growth in both output and utilization in July may, in fact, be signs of the “green shoots” many economists are looking for in the US economy.

Do these numbers tell you anything good or bad about the prospects for the economy in general and US manufacturers specifically? Are you surprised more manufacturing capacity hasn’t left the US market, in terms of factory closing? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest

|