Earlier this week, we wrote a story about how historically low natural gas prices could literally be fueling a manufacturing renaissance in the rust belt areas of the Midwest and more broadly across the US. (See Could Low Natural Gas Prices Drive Manufacturing Renaissance in Midwest?)

Heavy users of natural gas as a raw material in such industries as chemicals and fertilizers have started to make some moves to build new factories or expand production capacity at existing plants in the Midwest, such as the plans Shell has for a massive new chemical plant in Western Pennsylvania. The company is currently negotiating with the state over the usual tax relief and such, but it looks like it is happening. The first new fertilizer plant in the US in 20 years is being built in Iowa.

Other industries such as metals and glass use huge quantities of natural gas as a fuel, enough so that the dramatically lower US natural gas prices are enough that companies in those sector may also decide to expand in the US rather than offshore.

The driving factor here is that the non-conventional drilling extraction techniques such as fracking are opening up vast reserves of natural gas, much of that in the Marcellus shale range that runs from Western New York and Pennsylvania through West Virginia and Southest Ohio. That gas can been moved by pipelines directly to consuming factories for very little money. The vast supplies now available have pushed prices way down and are expected to keep them there for many years - in the US, that is.

And that is the key - natural gas prices are much higher in most of the rest of the world.

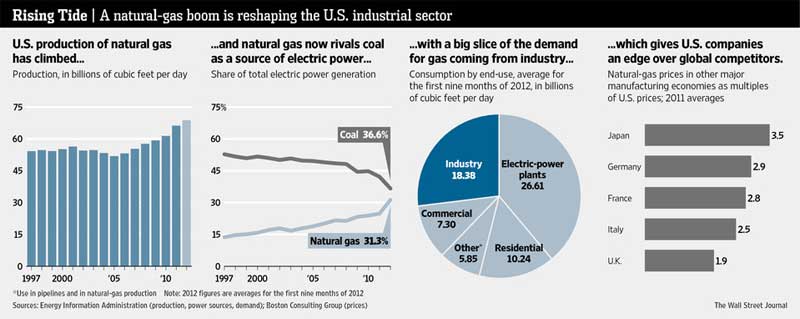

The chart below, from the Wall Street Journal, shows a variety of interesting statistics relative to natural gas in the US - but the most important one is on the far right. As can be seen, natural gas prices worldwide are far above those currently seen in the US.

Another source says that right now, nat gas prices are under $3.00 per thousand cubic in the US, down

dramatically from about three times that in 2008 and even higher in

2006. Meanwhile, natural gas prices are about $10.00 currently in Europe

and $15.00 in parts of Asia. That is partly because much of the world needs to use liquidized natural gas for ocean shipping from source to consumer- a very expensive process versus piping the actual gas with know conversion and deconversion.

Source: The Wall Street Journal

That means the Midwest might just be the world's low cost manufacturing region for sectors such as chemical and fertilizers. And give the US a logistics advantage as well as move to natural gas trucks.

We continue to believe that natural gas usage in manufacturing and logistics is going to transform the US economy over the next 5 years. Get ready.

Any Feedback on our Supply Chain Graphic of the Week? Let us know your thoughts at the Feedback button below.

|