How many companies play some games in the fourth quarter to make their working capital numbers look a bit better than they really are, including manipulation of some key supply chain related metrics?

A new report from REL says quite a few, as it analyed data from 979 non-financial public companies, finding that in total the group reduced their net

working capital (NWC) from Q3 2011

to Q4 2011 by $24 billion, only to let it

increase in Q1 2012 by $42 billion.

The study says that in the 459 of the 979 total companies analyzed that appeared to be playing some sort of numbers games, NWC fell by $52 billion from Q3 2011 to

Q4 2011 only to bounce right back in Q1

2012 by $53 billion.

The obvious goal: make the Q4 numbers look better to Wall Street, as investors make decisions for the new year.

There are several components to calculating working capital, and two are very supply chain related.

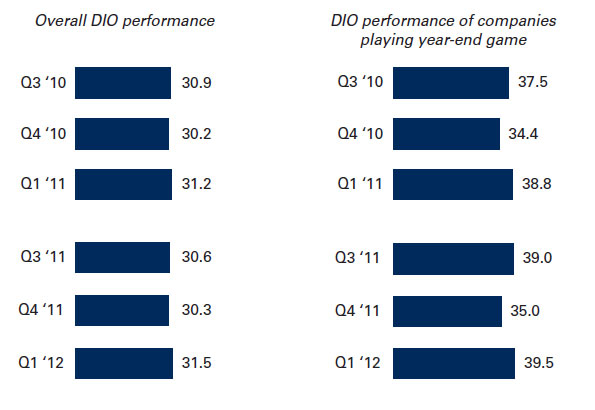

The most prominent supply chain related metric is of course inventory levels. REL uses the metric Days Inventory Outstanding (DIO) to measure inventory efficiency, which calculates how many days of sales a company holds in inventory. It is sort of the reverse of using inventory turns, so the higher the number, all things being equal, the less inventory efficiency a company has. Lower DIO shows improvement.

As can be seen in the chart below, among the manipulators, DIO dropped noticably from Q3 to Q4 in 2010 and 2011, only to shoot back up again in Q1 of the following year.

Inventory Numbers Among the Q4 Working Capital Manipulators

Source: REL

REL noted that with regards to inventory, among the games played are "refusing to receive materials from

suppliers or sending out products before

they are due to be shipped. Both can be

remedied."

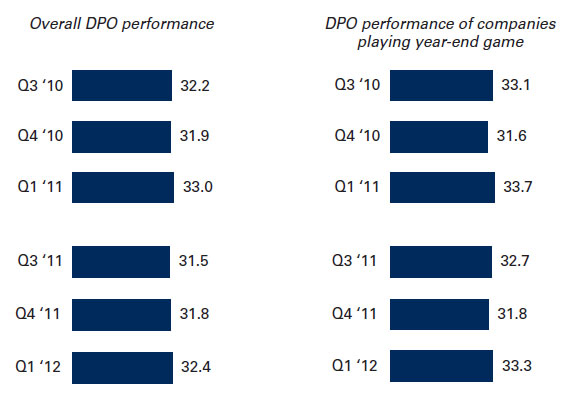

The same pattern held true for Days Payable Outstanding, which is a measuee of how long a company takes to pay its suppliers. Here again, the number drops in Q4, only to rise back up again in Q1.

The changes may not look that significant, but they can improve certain company financial ratios and drop working capital enough in absolute terms to impact investor thinking - or at least these companies appear to believe that. These two metric areas were among several others areas of manipulation REL called out in its analysis.

REL argues these kinds of games are ultimately self-defeating.

"Tremendous incentive exists for

companies to start putting in place

long-term sustainable processes

to allow them to avoid year-end

gamesmanship," the company says. "Manipulating working

capital numbers is expensive, hugely

distracting and potentially harmful to

customers and suppliers.

Any Feedback on our Supply Chain Graphic of the Week? Let us know your thoughts at the Feedback button below.

|