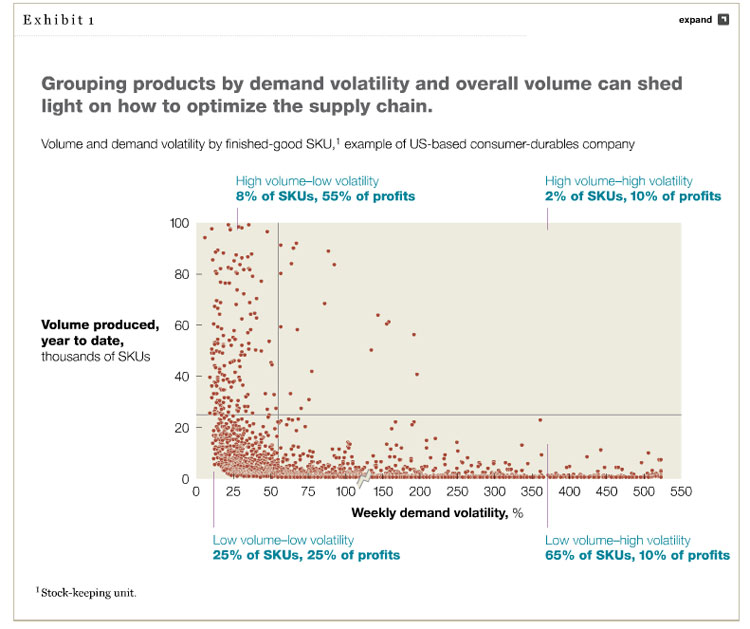

For readers of these pages, the benefits of detailed SKU velocities and variabilty will come as no surprise, but we were still interested in a recent article in the McKinsey Quarterly that described the benefits of looking at a real company's total SKUs by sales volumes and demand volatility.

The data showed in the chart below are from a US-based consumer durables manufacturer that had moved most of its production to China over the past decade, and according to McKinsey wound up in a position where all of its plants used a unified production-planning process in which each factory "essentially manufactured the full range of its thousands of products and their many components."

Source: McKinsey Quarterly

After analyzing its portfolio of products and components along two dimensions - the volatility of demand for each SKU it sold and the overall volume of SKUs produced per week - the company began rethinking its supply chain configuration.

"Ultimately, the company decided to split its one-size-fits-all supply chain into four distinct splinters. For high-volume products with relatively stable demand (less than 10 percent of SKUs but representing the majority of revenues), the company kept the sourcing and production in China," McKinsey says.

At the same time, the company made changes so that the facilities in North America were responsible for producing the rest of the company’s SKUs, including high- and low-volume ones with volatile demand (assigned to the United States) and low-volume, low-demand-volatility SKUs (divided between the United States and Mexico).

Perhaps even more interestingly, McKinsey says that "For the portfolio’s most volatile SKUs (the ones now produced in the United States), the company no longer tried to predict customer demand at all, choosing instead to manufacture directly to customer orders. Meanwhile, managers at these US plants created a radically simplified forecasting process to account for the remaining products—those with low production runs but more stable demand."

This kind of very basic analysis across the suppy chain can often produce important supply chain insights - more companies ought to do it more often.

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below.

|