The "Great Recession" has been followed by a strange and slow recovery that has often seen seemingly contradictory economic numbers, very modest growth by historical recovery standards, and of course to date a largely jobless recovery.

What gives, in the US at least?

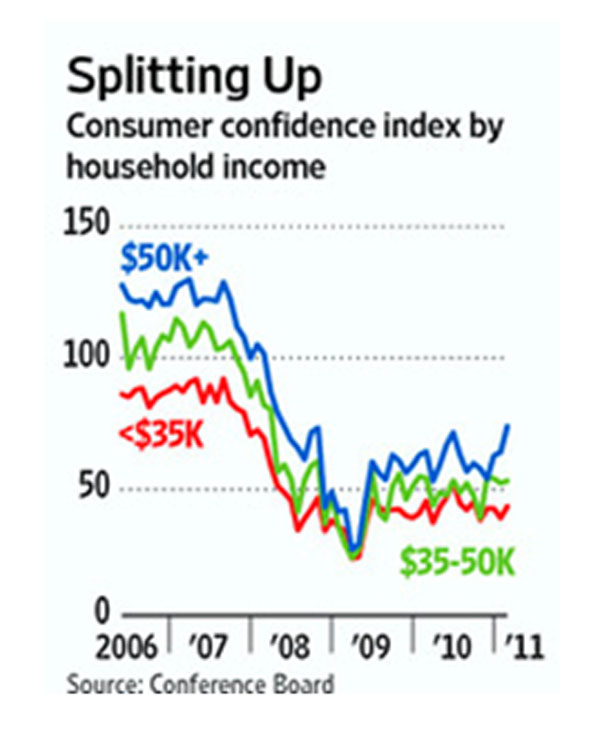

The chart below may offer some of the answers. It shows data on US consumer confidence as reported by the Conference Boardm and compiled this week by the Wall Street Journal.

That data is stratified by household income. It tells an interesting tale.

Source: Wall Street Journal and the Conference Board

As can be seen, consumer confidence in the economy dropped sharply in all three economic strata as the recession first hit in 2008, followed by a nice jump for all three groups in the last half of 2009.

But in the past few months, the lower two economic groups have seen their confidence levels flatten out, while those with higher incomes (actually in this case a using the rather modest baseline of $50,000 or more per household) has risen steadily. At those upper income levels, confidence is up nearly 50 percentage points from the bottom, much more than the middle group, and even more so than the bottom segment, which is only up 20 percentage points or so from the nadir.

As consumer confidence is a huge driver of spending, especially discretionary spending, this data can be seen as having a huge impact on aggregate consumer demand.

Add to that rising gas and food prices, and there is a real crisis emerging for demand from the lower income segments.

The bottom line: better times ahead for the Neiman Marcuses and others focused on the higher ends of the market, with more challenging times perhaps to be seen for manufacturers and retailers more dependent on spending from lower income customers.

Seeing this trend, WalMart as a stock was was downgraded by J.P. Morgan analysts Monday. The data may worth using to tweak sales forecasts moving forward, depending on a company's target markets or percentage revenue from different types of consumers.

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below.

|