|

Is there really any more vexing topic than supply chain collaboration? Every couple of years, I write a column on this subject, and my own views continue to shift – though this year, I have some new clarity.

I will admit to being a bit of a cynic. There is simply too much blah, blah, blah in the discussion of collaboration, from my view.

Clearly, there are many benefits that can come from various forms collaboration (see below). But I am not sure that the lack of collaboration is quite the stumbling block to supply chain success that many pundits seem to suggest; perhaps stated better, there are really limits to how much collaboration we can expect, and maybe we should just live with that.

Despite the calls for more collaboration at conference presentations, industry associations, etc., the situation never seems to really change. I suspect we’ll be hearing the same calls for more collaboration 10 years from now as well. You can make a career out of it.

A few years ago, our contributor Gene Tyndall touched on a similar theme:

“The ‘continuous process of sharing, partnering, connecting, and aligning to improve supply chain performance, for win-win benefits’ – which is what collaboration really is – is stalled, at best. The challenges have mostly been cited: trust; cultural differences; organizational barriers; unsustained executive commitment and involvement; technology differences; etc.”

Gilmore Says: |

But talk is cheap – this time in a good way. I think we could solve a lot of our “collaboration” problems by simply communicating more deeply and consistently. But talk is cheap – this time in a good way. I think we could solve a lot of our “collaboration” problems by simply communicating more deeply and consistently.

Click Here to See

Reader Feedback

|

Below you will find what I hope are a few interesting comments on supply chain collaboration:

- Clearly, the call for more collaboration depends on where you sit. The most vocal calls for more collaboration generally come from suppliers/service providers, who wish their customers/clients would share more information with them (naturally), and often in truth see collaboration as a way to drive more business with/through that customer/client.

Certainly, there are also many ways where collaboration can reduce supply chain costs, but in either case suppliers often myopically think their priorities should also be those of their customers. Sometimes yes, sometimes no.

Customers/buyers, on the other hand, tend often not to really differentiate much between collaboration and compliance. When you carry the heavy stick that is the purchase order, the line between collaboration and compliance is a very fine one indeed. As just one example, who wouldn’t want to be considered one of a customer’s “strategic suppliers?” But the buyer calls the shots on that one.

- I like Dr. John Gattorna’s observation a few years ago in his book Living Supply Chains that too many companies waste time trying to collaborate with trading partners who aren’t interested in collaborating. This leads not only to frustration but also diverting resources that could be applied to trading partners that really do want to collaborate. Per the point above, this usually, but not always, involves suppliers/service providers wasting time trying to collaborate with recalcitrant customers, rather than the reverse.

- In one of our supply chain videocasts last year, Procter & Gamble’s Jim Flannery made the insightful comment that real collaboration can only arise from real commitment. It can cost a lot of money and tie up a lot of resources to integrate systems and build joint supply chain programs. What company is likely to do this, Flannery asked, if there is not real commitment from the other side in terms of strategies, programs, purchase commitments, etc., that will give the partners confidence in the ROI from that investment? But how often are those firm commitments really there?

- Clearly, there are cross currents going on. Despite the calls for more collaboration, I see continued increases in “auction” type buying –and brutal pressure on pricing even in normal types of buying relationships. Witness the trucking market in the past two years. Can supply chain collaboration really thrive in this type of environment, independent of the overall state of the relationship? We should invest in collaboration, even though the relationship couldn’t withstand a 2% increase in costs?

A key and as yet largely unanswered question is how you even define collaboration. I have seen very few really attempts at this. Tyndall offers the CSCMP one above, but that is pretty broad. Let’s break it down.

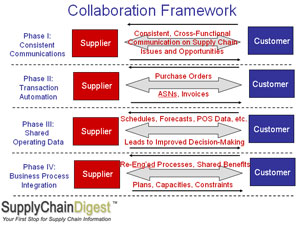

A few years ago, I introduced a collaboration model, which I have revised for 2010. You can find an image of that model shown in miniature below, with a link to a larger version:

Larger Image

The model suggest four levels:

Level I: Consistent Communications: It is amazing sometimes how little trading partners really talk in meaningful ways about what’s going on and potential opportunities for joint improvement. It has to start here.

Level II: Transaction Integration: Automation of basic business processes and transactions, using EDI, the Internet, or proprietary connections. As this takes investment, it is a form of collaboration.

Level III: Information Sharing: These same or other tools are used to provide trading partners with information that helps them make better decisions. There are many examples, from sharing of production, component, forecasts, inventory levels, POS data, and more.

Level IV: Business Process Integration: Involves true joint planning, process re-design across the trading partner interactions, and most importantly, sharing of risk and reward from the efforts.

So what’s the bottom line? What I now really believe is that calls for abstract collaboration are largely empty rhetoric.

What both sides of the trading partner equation need to do is to calibrate the nature of the relationship, using a model something like that which I have offered. Each relationship likely has its own sweet spot – though clearly buyers and sellers may differ as to what that is.

Nevertheless, that sweet spot is probably there for some period of time. If you are a large enough channel master, you can largely dictate those terms. But even at the largest companies, some level of commitment has to become the foundation of the higher levels of collaboration, where real investment must be made.

But talk is cheap – this time in a good way. I think we could solve a lot of our “collaboration” problems by simply communicating more deeply and consistently. And that doesn’t cost much at all. Why don’t we do it more often?

How do you define supply chain collaboration? Should companies more formally segment their collaboration strategies by trading partner? Is the best approach simply more communication – and why doesn’t that happen? Let us know your thoughts at the Feedback button below.

|