Gilmore Says: |

Look at the resulting impact on cash flow, a critical metric for both supply chain performance and how investors value a stock: it rose an incredible 25% over the same period, more than four times the level of sales growth. Look at the resulting impact on cash flow, a critical metric for both supply chain performance and how investors value a stock: it rose an incredible 25% over the same period, more than four times the level of sales growth.

Click Here to See

Reader Feedback |

Last June, I wrote one of my most popular First Thoughts columns of all time, which I called "A Little Supply Chain Finance 101."

The idea

for that column was a series of conversations I had recently had at the

time with different supply chain professionals that indicated to me a

lot of us just aren't that comfortable with how supply chain connects

with a company's financial performance overall, and especially it

impacts three key financial statements: the income statement, the

balance, sheet, and the cash flow statement.

This is especially tricky when it comes to inventory reduction.

Just

how does lowering inventories impact those three core financial

statements? That's what I explained in the column last year.

At

the time of the column, I promised a video version within weeks. Many

of you wrote in to offer some nice words about the column itself, and to

say you were looking forward to the video.

Well I am glad to say that a bit more than a year later, it is finally done.

You can watch the video at the link below. I think it came out pretty well, if I do say so myself. It packs a lot of insight into about 9 minutes. I am confident you will find it information and even interesting, at least as interesting as supply chain finance can be.

It

was fun to put together. But the efforts was such I am going to let the

video do most of the work this week. I encourage you to take a look,

and suggest it may be good to show at a supply chain lunch meeting or

something.

I will add a couple of more thoughts here though.

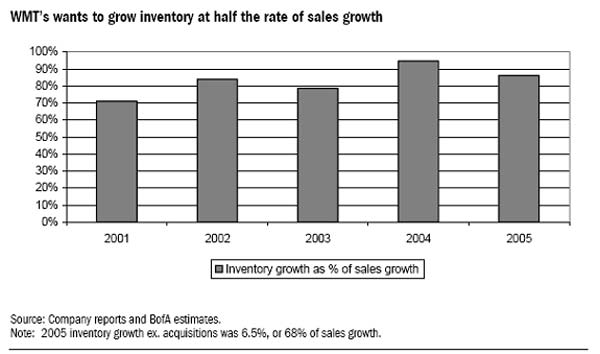

In

the mid-2000s, mighty Walmart's supply chain found it was actually

letting inventories grow too fast, much faster versus sales growth than

had historically been the case.

As

shown in the graphic below, inventory growth reached more than 90% of

sales growth in 2004, and just under 90% in 2005, versus say 70% in

2001.

As

Walmart acknowledged this problem, it said it wanted to get that metric

down to just 50% of sales growth, and launched the ReMix program,

lowered SKU and vendor counts, and took other measures to get

inventories under control.

Why

do I bring this up? Because Walmart's subsequent success in reducing

those inventories illustrates in part how supply chain does intersect

with the financials, as we explain in the video.

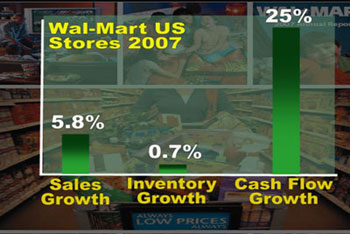

In

2007, as shown in the chart below, Walmart grew US store sales 5.8%.

But this time, inventories rose just .7%, a small fraction of sales

growth number.

But

more importantly, look at the resulting impact on cash flow, a critical

metric for both supply chain performance and how investors value a

stock: it rose an incredible 25% over the same period, more than four

times the level of sales growth.

This is part of the power of supply chain on company financial performance.

We

explain all that and more in the video. Hope you enjoy it. If you have

any ideas on other tutorials you might like to see, just let me know.

Did you view our Supply Chain Finance 101 video?

Any comments? Any other tutorials you would like to see? Let us know

your thoughts at the Feedback button below. |