|

I first wrote in these columns about Peak Oil five or six years ago, at a time when very few had ever even heard the term.

A lot more know it now, though rarely do half the people in a room say they know what Peak Oil is all about.

Chuck Taylor sure does. A lot more than I do. And we all need to listen up. More on that in a minute.

Gilmore Says: |

At one point in the broadcast, I referred to "Peak Oil theory," and Taylor in his very friendly way shot back "it's not a theory, it's a fact. Oil wells are very predictable.

Click Here to See

Reader Feedback |

Peak Oil is a concept derived from the work of a Shell Oil engineer back in the mid-1950s named Dr. M. King Hubbert. To the dismay of his employer, Hubbert wrote a paper from his study of the behavior of oil wells. Naturally enough, when wells are young and contain a lot of pressure, the oil comes out pretty easily. That flow then diminishes over time, and the oil is harder to extract. It becomes fairly easy to predict, Hubbert said, when the maximum output from a given well will be reached. After its peak production for say a year’s time, output will then decline over time even though there may still be a good amount of oil left in the ground.

That concept can be taken from an individual well to an entire oil field, and to a nation, and even to an entire globe. At the time, Hubbert did in fact predict that the US would reach Peak Oil in 1970, to the scorn of many other oil men at the time.

He was almost dead nuts on.

Enter Chuck Taylor. He is a former senior logistic executive for Nabisco and others, and grew up in Texas oil country. In the early 2000s, he started taking a look at what was happening with oil markets and costs, and dug deep into Peak Oil, which almost no one had heard of at the time. He became alarmed at what he was learning, and wondered why there weren’t more people discussing trends in oil, and its ultimate impact on our supply chains – and perhaps even our very way of life.

So he started Awake! Consulting really as almost just a service to the industry to lay out where he sees energy prices going, and what governments and companies ought to be doing about it. He estimates he has spoken in front of some 8000 people in total over the last few years on this topic, and that included a few hundred on a videocast two weeks ago on our Supply Chain Television Channel.

I was somewhat knowledgeable and concerned about Peak Oil before. After seeing Taylor’s presentation, I am both a lot more knowledgeable and a lot more worried.

So I will start with what is really the bottom line: we are not going to run out of oil any time soon. What we are running out of, as should be readily apparent right now, is cheap oil. And the time to prepare for this eventuality is right now.

Taylor says on a global basis, Peak Oil may have already been reached, and if not quite yet it will be over the next few years for sure. While oil demand is actually declining slightly in highly developed markets like the US, much of Europe, and Japan, it is going to continue skyrocket in developing nations in Asia, the Middle East, Latin America and Africa. That will much more than overwhelm the decreases in consumption in the US and elsewhere.

Consider this fact: the developed world uses about 14 barrels of oil per person per year. The developing world uses only about 3 barrels per person per year, and China by itself still just 2. That is simply going to change, Taylor said on the broadcast. "They’re going to get their share," was how he put it. Just think of the impact on supply and demand as that annual usage normalizes across the world.

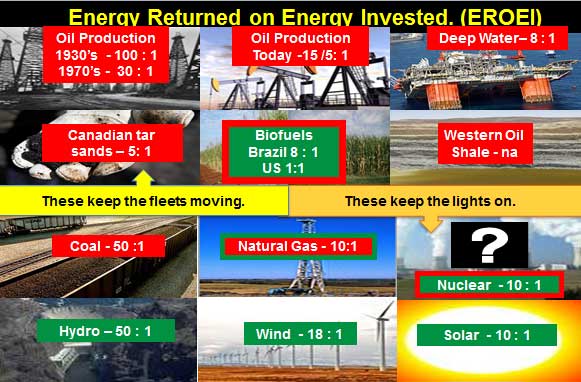

Taylor used the graphic below, which shows what he calls “Energy Returned on Energy Invested. (EROEI)” It illustrates how much oil itself was used to produce a barrel of oil over time and across different sources. It is a mind-opener. Decades ago, 100 barrels of oil were produced from just one barrel of energy consumed. That dropped to 30 produced by the 1970s, and 15 today from traditional sources. Deep water? Now you get just 8 barrels returned from each barrel used. What about tar sands, which many view as a lifeline of sorts? Now it’s just 5 to 1. And that doesn’t include all the other huge costs in deep see drilling or processing tar sands, versus the Beverly Hillbillies type oil that just spewed out of the ground when the right hole was dug decades back.

And that is again the main point – these and other sources will provide oil – it just won’t be cheap oil anymore. These exotic sources set a price floor based on costs, they are hard to find and develop, and for there to be cheap oil, "it needs flow, like Saudi Arabian oil," Taylor says.

At one point in the broadcast, I referred to "Peak Oil theory," and Taylor in his very friendly way shot back "it's not a theory, it's a fact. Oil wells are very predictable."

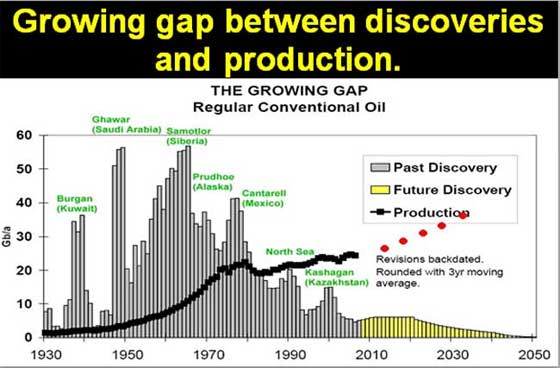

And so consider this chart. The picture it paints is not a good one. First, look how few new reserves are being discovered, versus the huge oil field finds in the 1950-80 period (gray bars, versus small expected future finds in the yellow bars).

You can also see in the black line how production levels, despite rising overall global demand, have been flat-lining in recent years: just what you would expect with nearing Peak Oil.

The red dots indicate the amount of production needed to keep pace with demand. Something is going to have to give.

Taylor thinks not nearly enough companies are really adequately preparing for the changes that are coming (we sub-titled the broadcast Is your Supply Chain Already Obsolete?), and that governments aren’t doing much of anything. And he really believes that the way our supply chains and society work is going to be altered as a result of rising oil prices (and soon). There may be many more new regulations on the movement of freight, as just one example, Taylor says.

Yikes! is the reaction most of us would and should have to all this.

There was a lot more. The broadcast is available on-demand here: The End of Cheap Oil Part 1. I encourage you to view it. In part 2 on May 15, Taylor is going to offer his thoughts on what companies and governments should be doing, and offering his “Peak Oil Checklist.” I am looking forward to that one too. You can register here: The End of Cheap Oil Part 2

Thanks to our sponsor Compliance Networks for making these two great programs available.

Are you worried about Peak Oil? Is a game changing energy situation soon going to be upon us? Or do you think alternative energy sources, etc. will carry the day in time? Let is know your thoughts at the feedback button below.

|