Most supply chain professionals are probably familiar with the monthly US Purchasing Manager's Index (PMI) for manufacturing data, released the first business day or each month by the Institute for Supply Management.

A few days later, another PMI for the US services sector is released by ISM. Both take a read on the state of the economy, with a score above the 50 mark indicating expansion in the manufacturing and/or services sectors, and scores below 50 contraction.

Supply Chain Digest Says... |

|

| The article also suggests supply managers or executives can also use the data to create a concise one-page report that summarizes overall economic conditions and what is happening in a company's own industry. |

|

What do you say? |

| Click here to send us your comments |

|

| Click here to see reader feedback |

|

|

Those are the headline numbers that receive most of the press attention, including monthly coverage on our weekly Supply Chain Video News broadcasts each Monday morning, in conjunction with CSCMP. The PMI scores can even affect the behavior of the stock market if the numbers are much different than expectations.

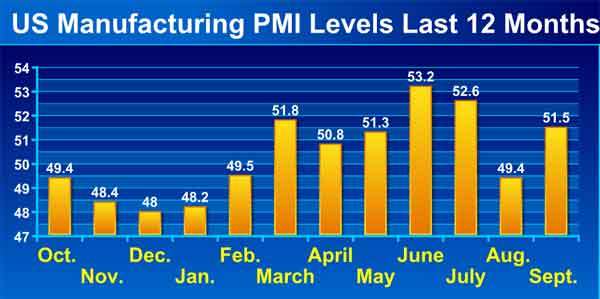

Below you will find a chart of the last 12 scores for the manufacturing PMIs through September, showing a fairly tight range for all the scores in the chart a little above or a little below the crucial 50 mark, indicative of the generally lukewarm US economy over that period.

But the ISM reports have much more data than just the overall PMI scores, tracking for example new order levels, purchase prices, inventory levels, employment and more. And as noted in a recent article in ISM's Inside Supply Management magazine, this is about as close to real-time economic data as there is available in the US.

That's because the report is developed from surveys of roughly 350 purchasing managers each for the manufacturing and services data sets, with the responses coming in from a regular group of contributors from US businesses just a few weeks before the reports are released each month.

As an example of the other data that is available, each month's manufacturing report notes which commodities are trending up in price and which ones are viewed as being in short supply, along with how many months that upward pricing or supply shortage has been seen. The report for September, for example, found caustic soda, garlic, polyethylene, steel and titanium dioxide, among other commodities, were seeing rising prices – steel for nine straight months.

And there are other opportunities for supply managers to use the monthly ISM data to make more informed procurement decisions?

ISM's macroeconomic indicators can help supply managers make microeconomic decisions for their organization. They can be used to spot pricing trends and to indicate future inventory shortages or surpluses, the article says. The data can also help supply managers see where your company stands in relation to the rest of its industry.

Retired supply management professional Tim Fiore, the 2016 J. Shipman Gold Medal Award winner for procurement, says he used the commodity lists to get an idea of what supply-related actions to take.

(See More Below)

|

CATEGORY SPONSOR: SOFTEON |

|

|

| |

|

|

"We would use it to come up with different strategies on how to address the market, whether to make long-term or short-term commitments, or whether to commit for just spot buys. We used the information on commodities in short supply to determine whether we were seeing the market like everyone else is or not," Fiore told ISM.

In addition, the Buying Policy section in each manufacturing report details the average commitment lead times for capital expenditures, production materials, and maintenance, repair and operating (MRO) supplies.

This data can be used to estimate how long it will really take to get goods if after an order has been placed - and offering a chance to perhaps avoid being caught off guard when sourcing various goods or materials that might have longer than normal lead times.

Norbert Ore, former procurement executive and former chair of the ISM Manufacturing Business Survey Committee, suggested supply managers should also look at the Supplier Deliveries Index in comparison to the Prices Index.

"If lead times move from two to three weeks, then deliveries are slower and demand has increased, thus, the economy is growing," he said. "If you look at May's report, for example, Supplier Deliveries shot up from 49.1 to 54.1. That's a significant move," he says. "Prices, which were already at 59, went up to 63.5. That tells me there was a short-term rise in demand and that we're going to pay a little higher price for that short-term pickup. If that situation extends, it's going to have longer-term implications."

Ore added that "One of the things a buyer has to ask is: Is this just a blip on the radar screen? Or is it significant? If it's a shift, is this a first indication that we may be moving toward greater demand and weaker supply?"

The ISM data can also be used for overall business planning.

Fiore, for example, said that in three of the companies for which he has worked, business leaders and financial planning and analysis staff used the PMI data to help develop the following year's business plan and to gauge how the company was faring compared to its current year's business plan.

"It was one of four or five economic indicators we used as a prediction of the market we sold in," he said.

Another potentially valuable approach is to analyze data on Inventories and Customers' Inventories to get a picture of what is happening with raw materials and intermediate components (Inventories) and finished goods (Customers' Inventories), Ore noted. "Then take the New Orders Index and subtract the Inventories Index. What you want is for new orders to be growing faster than inventories. If new orders grow, inventories have to grow. But you don't want inventories to grow as fast as new orders. If they do, you may become overstocked."

The article also suggests supply managers or executives can also use the data to create a concise one-page report that summarizes overall economic conditions and what is happening in a company's own industry as well as related sectors say focused a company's supplier base.

So there is indeed much more to the monthly ISM reports than just the headline PMI numbers. Supply managers should consider taking a deeper look at the data to make more informed decisions.

Do you think there is an opportunity to more fully use the ISM data? Are you doing so now? Let us know your thoughts at the Feedback section below.

Your Comments/Feedback

|

|

Sandy

Campbell, Student at Strayer University-Purchasing and Contract Management |

Posted on: Jul, 24 2017 |

|

I have just an idea of very good resources to expand on my reading. The Montly ISM data that provides the PMI data sets can also be used for forecasting assuming stichastic turbulences in the Market. It can be utilized at great length to offer critical analysis utilizing quantitative econometric models and techniques. My interest has been stimulated. I shall continue to be reading the monthly ISM data with a view to using it for any future research or policy paper I may need to write. Kindly include me in the mailing list. Thanks.

|

|

|