UPS as usual matched rival FedEx with plans to increase base parcel shipping rates by 4.9% on average for deliveries starting in late December.

That's business as usual for the parcel giants, and is really just the starting point for negotiations - at least for large and some medium shippers.

But this year, the impact of the standard general rate increase will be exacerbated by expansion of so-called "dimensional weighing" programs, also set to take effect at the start of next year. Dimensional weighing is basically a way for the carriers to be able to charge both for the weight and for the cube of a parcel - whichever is more in the carrier's favor. But this year, the impact of the standard general rate increase will be exacerbated by expansion of so-called "dimensional weighing" programs, also set to take effect at the start of next year. Dimensional weighing is basically a way for the carriers to be able to charge both for the weight and for the cube of a parcel - whichever is more in the carrier's favor.

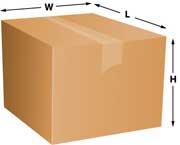

Dimensional weight is determined by first multiplying length by width by height in inches, thus calculating a parcel's cube.

That number is then divided by 166 for domestic shipments, and by 134 for international freight.

That number is the "dim weight." If the package weighs more than the dim weight, the shipper pays based on the actual weight. If the package weighs less than the dim weight, the shipper is charged for the more expensive dim weight instead - a price increase versus the traditional policy of charging based on weight alone.

So for example, a box that is 12 x 12 x 12 (inches) has 1728 total cubic inches. Divide that by 166, and you get 10.4. If the package weighs 12 pounds, the shipper will pay the rate for a 12-pound shipment. If the package weighs 8 pounds, the shipper will pay for shipping a 10.4-pound box.

Between the general rate increase and the effective increase from dimensional weighing, some parcel shippers could see rates rise by high single or even double digit percentages. Ouch.

But remember - everything can be negotiated.

|