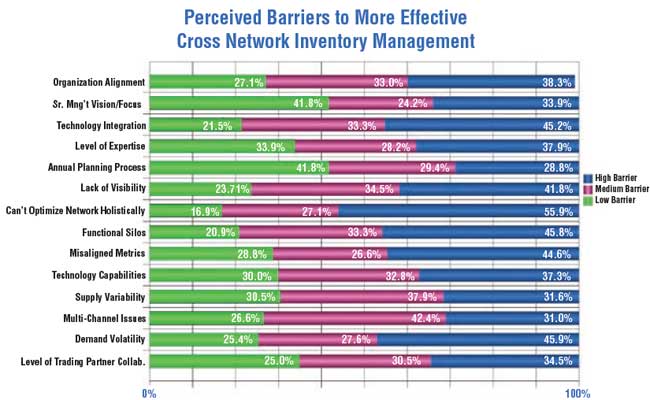

The survey later asked respondents what the larges barriers were they saw to improving network inventory management.

Those results are shown in the chart below. Some things stand out. For example, senior management vision/focus is not perceived to be an issue for most companies; nearly 42% rated it as a low barrier, and 66% combined rated it as either low or medium.

The annual planning process and supplier collaboration challenges also rated fairly low as barriers. On the other hand, 56% of respondents cited their inability to optimize the network holistically as a high barrier.

Other areas receiving high scores included lack of technology integration, having internal functional silos, misaligned metrics (related, no doubt, to functional silos) and demand volatility (as always seems to be the case).

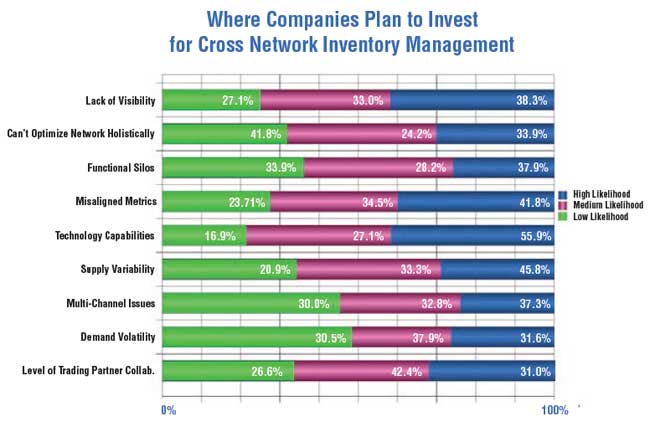

Finally for this article, CSCO Insights asked companies where their companies plan to invest to improve network inventory management. As shown on the chart below, technology scored high, with improving supply chain visibility (41.7%) and general enhanced inventory management/planning technology (also 41.7%) listed as areas many respondents said they were quite sure to make investments over the next 2-3 years.

There is a lot more data in the full report. That includes not only more survey responses, but a discussion of five smart ideas companies might consider to get a better handle on supply chain network inventory.

Does any of this survey data surprise you? What steps or investments are you taking to improve network inventory management? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |