Key 2007 Report Findings

From our view, the important or most interesting findings from the report include:

- 38% of respondents said their organizations had a chief supply chain officer or similar single executive in charge of the supply chain.

- Those with Chief Supply Chain Officers reported stronger supply chain results, but whether creating a CSCO role leads to the improved results, or companies with a strong supply chain orientation and performance are more likely to create such a role, is unclear.

- Not surprisingly, forecast accuracy continues to be a big supply chain concern. About 78% of respondents rate themselves in the bottom two-thirds of performance in terms of accuracy – a reversal of the usual over-rating of themselves most companies do, and probably just reflects how difficult forecasting is.

- 56% of companies review and update supply chain strategies only on a perceived “as needed” basis, rather than formally doing so on say an annual cycle.

- Internal collaboration across functions, not surprisingly, needs work in many companies. For example, only 39% of respondents agreed or strongly agreed that procurement decisions were based on consensus plans and forecasts. Only 36% of respondents rated their firm “high” in terms of using common product roadmaps and other procedures to guide product launches.

- Just 45% of respondents said their companies had a good feedback loop between supply chain plans and execution to identify the causes of variance to plan.

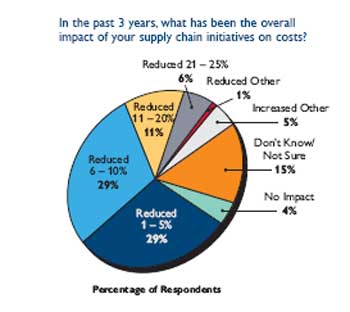

- 11% of respondents said that supply chain initiatives had reduced supply chain costs by 11-20% in the past three years. 6% claimed an amazing 21-25% cost reduction. 58% said costs had been reduced between 1 and 10%. The challenge, of course, in any such survey is getting the frame of reference. Is the cost reduction in absolute terms, or in reference to what would have been the results with the status quo? We suspect most answered from the latter perspective, which is more subjective.

The report notes accurately that “Most companies simply do not put the amount of effort into the planning area to truly match supply with demand. Rather, the focus is on supply chain efficiency in terms of cost, and planning is expected to follow in step with emphasis on throughput and efficiency.”

Leveraging Financial Data

The reports conclusions include a valuable point – that better integration of the supply chain with financial information and analysis can lead to much better decisions.

“There is a large opportunity for financial officers to be more involved in supply chain efforts, particularly drawing attention to the actual improvements that can be made to financial performance,” the report observes. “The leaders’ use of costing and financial information to impact strategy and tactics is evidence that a closer relationship can be beneficial.”

|