For the period in question, the researchers took the fuel costs reported each year by the five publicly trade rail carriers in their SEC statements. Two of those carriers (Union Pacific and Burlington Northern) also reported fuel revenues in those filings, while the others (Norfolk Southern, CSX and Kansas City Southern) did not. Snavely King used a conservative estimate of those carriers’ fuel surcharge revenues for the full analysis – and as with any estimates, these could be challenged.

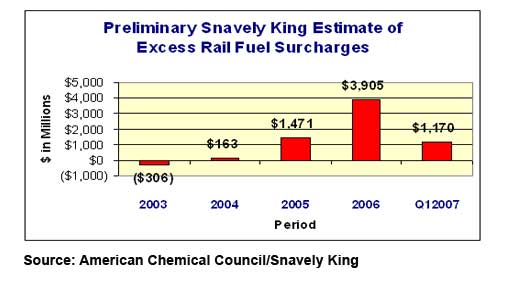

To estimate the alleged “overcharge,” the research simply calculated the incremental cost of fuel for a given year over the previous year, versus the incremental fuel surcharge revenue for the same period. To the extent the incremental revenue was greater than the incremental cost, it was deemed excessive – and this approach identified $6.5 billion in such overcharges over the analytic time period (2003 through the first quarter of 2007, after which the STB ruling became effective.).

In fact, as the chart shows, the analysis found rail carriers actually lost money on the cost of fuel versus the surcharges in 2003, made a slight profit in 2004, a larger profit in 2005, and then a giant profit in 2006 – almost $4 billion between the five carriers.

Importance of the Base Index

The report also notes the importance of the base fuel index in establishing surcharge levels. Most of these carriers have been using base pricing from as far back as 2002. For example, Burlington Northern and Union Pacific have based their surcharges on diesel prices of $1.29 and $1.35 per gallon, respectively – a level not seen since 2002.

The other carriers use the price per barrel of West Texas Crude in their calculation, with a base of just $23 per barrel, again far below current levels and reflective of the market price in early 2002.

The report does note that recently, Norfolk Southern has adopted a new rate base of $64 per barrel.

Are Rising Fuel Expense Built into Rates?

The other key allegation of the report is that carriers have been in effect double dipping, as rising fuel costs have increased operating expenses used to justify overall rate increases, and then more than recovering from the fuel surcharges themselves.

“It is essential that an effective index accurately captures short term changes in fuel prices. Though rates are not cost based, the railroad has the ability over the long term to change rates in order to reflect changes in its operating costs,” the report states. “Fuel as a percentage of operating cost has increased over the last five years, and railroads have considered those cost increases in proposing rates. Over time the fuel cost increases tend to be reflected in the base rate.”

It continues: “Accordingly, often fuel cost increases experienced in earlier time periods have been made a part of the base rate. When fuel costs decline, the railroads could continue collecting a fuel surcharge compensating for incremental fuel cost they no longer incur. This is clearly an unreasonable practice.”

Not All Carriers Benefited Equally

While the $6.5 billion is calculated across all five carriers for the period, the alleged surcharges excess were not equally distributed across them. Burlington Northern, CSX, Norfolk Southern and Union Pacific are all alleged to have overcaptured in excess of $1 billion each during the period. Although much smaller than the others, Kansas City Southern (KCS) seems to have overcharged relatively less, and the report says that “It should be noted that from 2003 through 2005, KCS did not recover enough fuel surcharge revenue to cover the year to year increase in fuel costs under conservative estimates,” though it says with more moderate estimates KCS did, in fact, book profits in that period.

Will Truckers Be Next?

Rail carriers are probably more subject to legal claims than truckload and LTL carriers because they are more regulated as monopolies in many service areas. Nonetheless, this work may result in similar claims and analyses for the truckers as well, whom many have also accused of boosting profits from fuel surcharges.

An analysis earlier this year from researchers at investment bank Bear Stearns, however, estimated that truckload carriers were not profiting much from surcharge fees, but that LTL carriers might be booking some extra profits from the surcharges.

Do you agree or disagree? Share your perspective by emailing us at feedback@scdigest.com |