As we reported earlier this week, Walmart is experiencing "deja vu alll over again" when it comes to SKU counts and inventory levels. (See Here We Go Again - Walmart Once Again Moves to Reduce SKUs Counts in Stores.)

The gist of the story is that Walmart is looking hard once again at paring SKU counts at its stores. That effort is being driven by disappointing earnings results and a sagging stock price of late, with the hope that these and other cost cutting measures can lift profits in the face of generally tepid top line gains.

Of course, this isn't the first time down this path for Walmart. In 2009, the retail giant also announced a major program to reduce SKUs in its US stores by as much as 20%, only to reverse course and bring about 8500 items back to stores shelves in 2011 after the reduction was deemed to have negatively impacted sales.

At the core of the issue is that in recent years, Walmart inventory levels have been slow to react to quarterly revenue changes, as seen in the graphic below this week from the Wall Street Journal, though recent efforts to get inventories back in line seem to be working.

Recent Changes in Walmart's Inventory and Sales Levels

Source:The Wall Street Journal

"It's the objective of every retailer to grow their inventory slower than sales," Walmart's US stores CEO Greg Foran recently said. "We just carry too much inventory. And we carry too much inventory across most parts of the box. And so we do have lots of work under way to get that sorted."

But once again, this too is deja vu all over again.

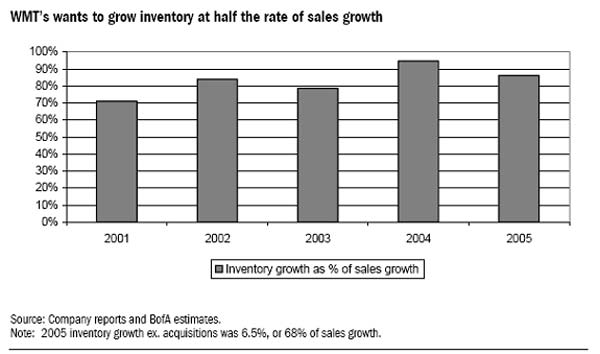

In the early and mid-2000s, Walmart let its inventories rise up as well, from 70% of sales growth (back when sales growth was much higher) to 95% in 2004, as shown in the chart below.

That in turn led to Walmart launching programs such as "Remix" and "Inventory Deload" in the mid-2000s to address the inventory bloat, programs that had an impact- at least for awhile.

Any Feedback on our Supply Chain Graphic of the Week? Let us know your thoughts at the Feedback section below.

|