Carriers Showing Some Optimism

Transport Capital Partners conducts a quarterly survey of carriers, and in the most recent one, carriers appear to think the market has finally reached bottom.

When asked about their prospects for the next 12 months, 36% of carriers in the survey expect to see an increase in volumes, versus just 16% that felt that way in the November, 2008 results.

“I think what this reflects is the optimism in the truckload industry that we have, in fact, seen the bottom and that things will start to get better in the future,” Batts says.

Where is Capacity Headed?

Of course, the dramatic fall-off in volumes has meant extreme excess capacity in the market, a resulting implosion in freight rates, and many carriers leaving the market.

Batts estimates that bankruptcies have idled around 150,000 trucks over the last five quarters, representing a reduction in capacity of 8 to 9%. In addition, many other still solvent TL carriers, especially larger providers, have voluntarily idled trucks.

As SCDigest has noted before, the market should have seen even more bankruptcies and lost capacity, except that many banks have not foreclosed on carriers that are not making payments or have defaulted on load covenants.

“I think over time what we’re learning is that lenders are not pulling the plug as we had expected, and again, it’s primarily because of the used truck prices,” Batts says. Because the domestic and especially overseas market for used trucks has also imploded, banks are reluctant to force a carrier into bankruptcy, because they can recover so little from the carrier’s assets.

“We were joking one day that a two-year old Ford 250 pickup is, in fact, worth more than a four-year old Class 8 truck,” Batts said.

That’s more than just a funny observation – it also brings into question whether the idled capacity is actually leaving the market. In the past, the equipment of bankrupt carriers was generally sold off to international markets in Eastern Europe or South America; now the trucks of both bankrupt carriers and trucks voluntarily idled are still here – and most of them could be brought back on-line when volumes return. That means the concerns of some that we could quickly return to tight capacity upon a recovery due to truckers leaving the market may be overblown.

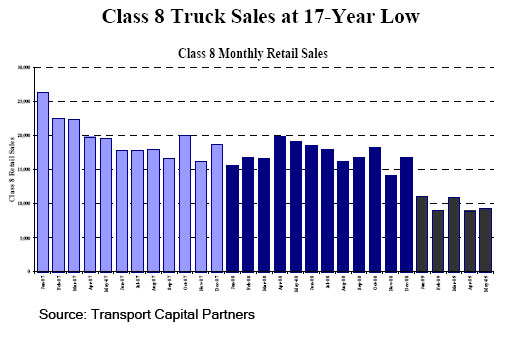

On the other hand, sales of Class 8 trucks in 2009 will likely see a 17-year low (see graphic), and Batts expects very few “pre-buys for 2010” as well. In addition, rising fuel prices, should they occur, could also trigger a fresh wave of carrier bankruptcies.

Batts says rising fuel prices have traditionally been a major driver of trucking firm failure. While “A lender may say to a trucking company, “Well, just make interest payments on these trucks or every other payment,” most fuel companies want to be paid within 24 hours, if not immediately.” Batts notes. “In fact, as fuel prices go up, we expect to see bankruptcies go up regardless of what the lenders do.”

Next week, we’ll share Batts’ views and research on the prospect for truckload rates.

What do you think? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest