SCDigest

Editorial Staff

| SCDigest Says: |

Wolfe estimates that about 20-30% of rail shipments overall fall into this “captive” shipper category, but that may overstate the case in a general sense, because a high percent of the captive shippers are coal producers/ Wolfe estimates that about 20-30% of rail shipments overall fall into this “captive” shipper category, but that may overstate the case in a general sense, because a high percent of the captive shippers are coal producers/

users.

Click Here to See Reader Feedback

|

Once again, the U.S. Congress is considering a bill that would open up competition for so called “bottleneck” rail shipments, a move that would be good for shippers and bad for rail carriers. The industry has dodged this bullet in the past, but may not be so lucky in the next two years.

What is the issue all about?

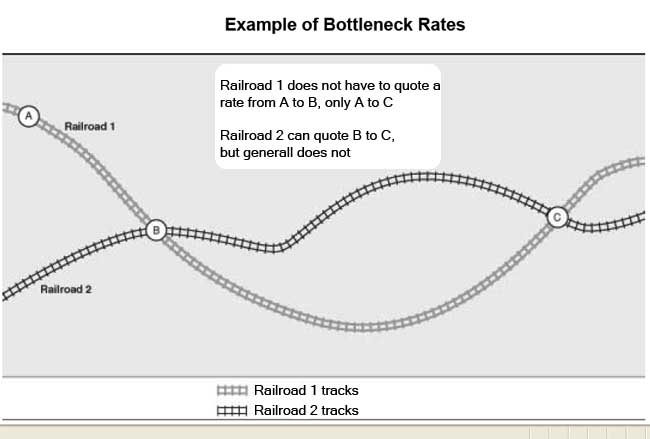

The U.S. rail network includes many situations in which only one railroad, often now referred to as the “bottleneck carrier," serves either an origin or a destination of a potential freight movement (the so-called “bottleneck segment,” but more than one railroad serves the rest of the line between origin and destination (the “non-bottleneck segment”). In other words, a shipper had two more carriers that serve both the origin and destination, but not the entire move, as somewhere along the way there is one or more “monopoly” segments.

Under current law, the “bottleneck carrier” has the option of either carrying cargo the entire length of the voyage or interchanging the cargo with another carrier over the non-bottleneck segment. The decision on routing is entirely up to the bottleneck carrier. This situation has been supported by rulings from the Surface Transportation Board (STB), which regulates U.S. rail carriers, and subsequent court decisions after shippers groups sought to overturn the rule.

As a result, a shipper cannot insist on a separate rate for the bottleneck segment by itself. Or, if the rail carrier provides a quote for that segment, it is high enough (combined with a lower quote for the second segment) that a shipper cannot reduce costs by splitting the move between carriers. That situation enables the bottleneck carrier to charge what many consider a monopoly price for the entire trip. (See illustration below).

(Transportation Management Article - Continued Below)

|