|

Last week, I discussed the topic of supply chain and where it appears we could be headed – oil prices at $150 or even (gasp) $200 per barrel. It generated a lot of reader feedback, which we will publish soon. (See Supply Chain and $200 Oil.)

Many of the cost impacts are easy to project. But how would it really influence supply chain network design?

|

Gilmore Says: |

The bottom line of the analysis – for this one company, at least, rising oil and transportation costs would impact profitability, but not core supply chain design, for the first few $25 increments in rising oil prices. But when you hit $150 – things really start to change. The bottom line of the analysis – for this one company, at least, rising oil and transportation costs would impact profitability, but not core supply chain design, for the first few $25 increments in rising oil prices. But when you hit $150 – things really start to change.

What do

you say? Send

us your comments here

|

That’s the question I recently ask Dr. David Simchi-Levi, one of the industry’s most recognized thought leaders. For many years, Simchi-Levi has been a professor at MIT. He has written several books and dozens of articles on supply chain, and was founder of Logics Tools, a provider of network design and related software that last year was purchased by ILOG.

Dr. Simchi-Levi volunteered to take a look at the impact of rising oil prices using data from a real consumer goods company. We are very pleased to be able to share the results with you here.

“This turned out to be a very interesting question. The results are not obvious,” Simchi-Levi told me.

Last week, I did my own “back of the envelope” calculations on how diesel and truckload freight costs would rise as oil went to $150 or $200 per barrel. Dr. Simchi-Levi did a related analysis, looking back over many years. His conclusion: diesel prices rise about 24 cents per gallon for every $10 increase in the price per barrel of oil. With carrier fuel surcharges running at something like a 1-cent increase for every 6-cent increase in diesel prices, Dr. Simchi-Levi concludes that for every $10 increase per barrel of crude oil price, there is an additional 4-cent per mile increase in transportation rates. This is the data he uses as the basis for his supply chain network analysis.

For the scenario analysis, Dr. Simchi-Levi took actual supply chain network data from a real consumer packaged goods company. The firm has three potential manufacturing locations – highest cost production in the Philadelphia area, slightly lower costs at a plant near Omaha, and lowest cost production in Juarez, Mexico. In its model, the company is evaluating 60 possible locations for distribution centers. Oil at $75 is used as the baseline oil price.

The bottom line of the analysis – for this one company, at least, rising oil and transportation costs would impact profitability, but not core supply chain design, for the first few $25 increments in rising oil prices. But when you hit $150 – things really start to change.

“At that point, rising transportation costs start to significantly impact both where products are made and what the distribution network looks like,” Dr. Simchi-Levi told me. “At that point, the rise in transportation costs starts to impact the trade-offs with manufacturing costs and the trade-offs with inventory costs. For example, it might be better off holding more total inventory by having more distribution centers in the network so you can get closer to customers and reduce outbound shipping costs.”

Based on total supply chain cost, for example, with oil at $75 the optimal manufacturing mix is to produce 22% of this company’s goods in the Philadelphia location, and 78% in Juarez. At $200 oil, however, the Philadelphia plant’s share rises just 1 point, to 23%, but Juarez’s share drops to just 54%, while Omaha enters the picture at 23% of total production. This happens because for many of the company’s internal moves, the higher manufacturing costs in Omaha would be offset by lower transportation costs versus Juarez.

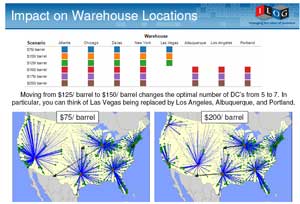

On the DC network side, things are similarly interesting. As oil goes to $100 and then $125, the optimal network design stays the same, with five DCs (Atlanta, Chicago, Dallas, New York and Las Vegas). But at $150, there is a dramatic change – the optimal network uses seven DCs, as transportation costs reach an inflection point. The Las Vegas DC is out, replaced with new facilities in Albuquerque, Los Angeles and Portland, as shown in the graphic below.

Click on Image for Larger Version

You can find an excellent slide deck detailing this analysis, courtesy of Dr. Simchi-Levi, on the SCDigest web site: Analysis of Rising Oil Prices on Supply Chain Network Design.

So what are the key takeaways? Dr. Simchi-Levi offers some thoughts:

- “This really makes the initiatives around reducing carbon emissions very interesting,” Dr. Simchi-Levi said. “Carbon emissions are clearly related to energy use. By reducing carbon emissions, companies will also be reducing the impact of rising oil prices. We need to de-couple or reduce the correlation between rising oil prices and supply chain costs.”

- He expects rising oil prices would have the effect of changing the way we think about outsourcing and offshoring, after 10 years of a mad rush to China and other Asian locations. “I would especially expect Mexico to become much more attractive,” Dr. Simchi-Levi says.

- In this era of dynamic costs and rapidly changing markets, companies must monitor and re-evaluate their networks on a much more consistent basis. Formal scenario and risk analysis is critical to that effort, he says. While no one knows where oil prices will go, as just one example, you need to understand what the impact would be, and make decisions that optimally considers risk and potential changes. This may often mean trading somewhat higher base supply chain costs for much greater flexibility down the road.

- By the way, even fully optimized, total supply chain costs rise 3% if oil goes to $150 for the consumer goods company. With the supply chain representing 70-80% of total costs for most companies, that would be a huge impact to the bottom line, depending on how much sell prices could be increased in the market.

That’s all we have room for. Thanks to Dr. Simchi-Levi for his efforts (which I know took a lot of time) for the benefit of SCDigest readers.

Anything surprise or strike you in Dr. Simchi-Levi’s analysis? How do you think about this problem? What is the right balance between cost and flexibility?

Let

us know your thoughts at the Feedback

button below. |