From my view - perhaps paradoxically to a degree given how dynamic the environment is today -companies seem to be focusing on supply chain planning like never before.

Why is this? Several reasons, I believe. Most prominent is the growing C-level recognition that of how critical alignment is to overall success and lower costs - and that planning in silos simply can't cut it anymore.

Second, growing complexity in business overall and certainly in the supply chain means things often feel they are on the verge of getting out of control - and companies look to find some way to address this complexity with tighter, more rigorous planning systems. Sometimes it even works.

Gilmore Says: |

After all these years, 45% of respondents still said their tools can't model all the processes well enough, followed by the 44% who said they were not well using all the capabilities their technology had to offer. After all these years, 45% of respondents still said their tools can't model all the processes well enough, followed by the 44% who said they were not well using all the capabilities their technology had to offer.

Click Here to See

Reader Feedback

|

Third, and certainly related to the first two, companies understand the future is tightly integrated planning and execution, to the point where as I have said many times in the past, tactical planning and execution will (and indeed are in many situations) start to look more like one process than separate steps (see Spanish clothing manufacturer/retailer Zara).

So with that brief backdrop, this column will summarize a benchmark survey and research report in supply chain planning we published towards the end of 2013 - this is literally the first open First Thoughts spot I have had since the report was published.

I can without a doubt say this is the finest research work we have done yet. It is I believe the most detailed study on planning I remember ever seeing, based in part on survey responses from about 400 supply chain professionals (from many great companies). It is produced it in an inforgraphic-type style that makes all the data very easy to get through. I promise you will enjoy it.

You can download the report here: 2014 Supply Chain Planning Benchmark Report

As usual, we'll offer a few highlights in this column. For starters, we could say it has been about 25 years since the start of we might officially call the supply chain planning era. Of course, companies have been doing some forms of planning forever, but I guess I am linking the beginning of this period with the arrival of modern supply chain planning software.

However you date it, we've been at it a long time, and you'd think most companies would feel pretty good about their planning capabilities by now.

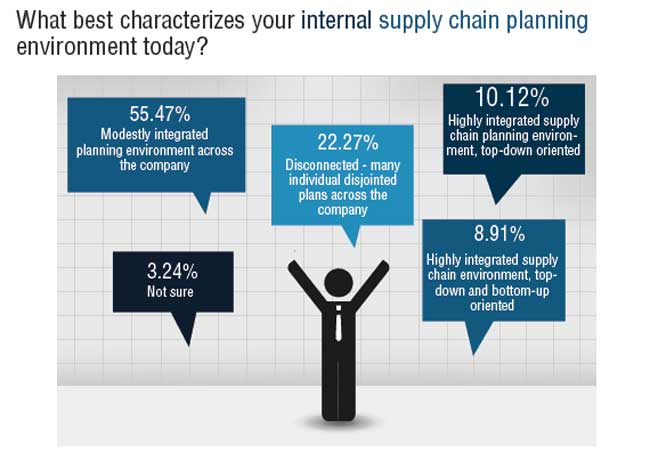

Think again. As the chart below shows, more than 22% - in in five - of companies still say said there planning processes are largely "disconnected."

Just under 9% have reached what today we might call the top levels of performance, characterized by highly integrated processes, and both a top-down and bottoms-up approach to planning. My question: is it that so many companies really are behind in their supply chain planning efforts and results, or that the bar just keeps being raised higher? A little of both I think.

I liked this chart and data points a lot, relative to how companies feel they are performing via supply chain tradeoff curves - such as the balance between inventory and customer service. It is quite fair to say that the only way to really make supply chain improvement is to "shift the curve" - be able to both reduce inventories and improve service over given period, or whatever the tradeoff area is..

Here's what companies told us relative to that question.

Just 13% or so feel they have been able to significantly shift their curves in recent years. My perception is that for leaders, it is a stair-step type journey - they are able to shift their supply chain performance curve in some area, then they plateau at that level for some period before making another advance. Most interesting of all in this data is that 25% just don't know - that's a big number. Do we need some better or easier way to measure this?

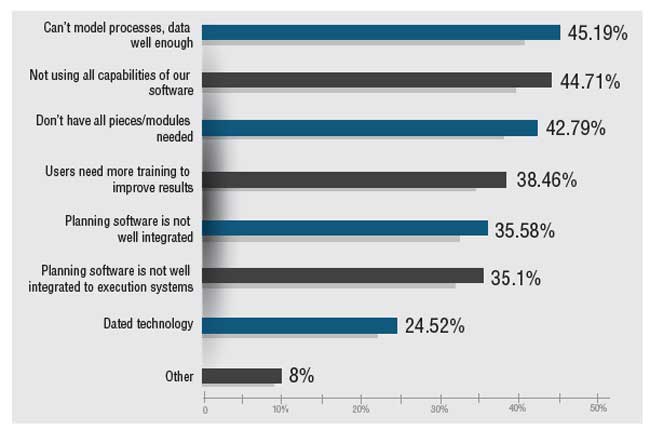

Finally, what do companies see as the biggest challenges in their current supply chain planning software environments? As shown below, after all these years, 45% of respondents still said their tools can't model all the processes well enough, followed by the 44% who said they were not well using all the capabilities their technology had to offer. I bet in reality it is an even higher percentage than that. 42% of companies said they were still missing important pieces of technology, such as Inventory Optimization software.

Biggest Supply Chain PlanningTechnology Challenges

I am not going to have room for the chart, but in great summary, the data showed that the high tech and consumer goods sectors had to best performing planning processes, while chemicals and retail said they were the most disconnected.

There is so much more - this is very good. Please take a look: 2014 Supply Chain Planning Benchmark Report

What is your reaction to this benchmark data on supply chain planning? Let us know your thoughts at the Feedback button or section below.

|