Rail carriers saw volumes really sag in Q2 across almost every segment, but most managed modest rate hikes in the quarter and overall profitability, while down on a year over year basis, remained strong.

Supply Chain Digest Says... |

|

| Net income as a percent of revenue for the group fell a bit, to 18.6% from 19.5% in Q2 2015. ompare that to an average of just 6.4% for our truckload carrier group |

|

What do you say? |

| Click here to send us your comments |

|

| Click here to see reader feedback |

|

|

We're back as usual every quarter with our review of the results and trends across freight modes, starting last week with US truckload carriers (see US Truckload Carriers Have Another Soft Quarter in Q2 on Weak Demand).

This week, we look at the rail transport sector, and then next week we'll review results and trends in the less-than-truckload group.

As part of that review we look at the four major Class I public carriers that make up the US rail sector (Burlington Northern is of course part of public company Berkshire Hathaway, but its results are not broken out in any detail and thus are not included).

Again in Q2, rail carriers are battling several negative trends when it comes to volumes. Those include: overall softening freight volumes in the US, perhaps a sign of a weakening economy; continued major declines in freight cars carrying coal; and falling diesel prices, which make truckload carriage increasingly attractive in many lanes, as fuel surcharge costs have plummeted.

According to the Association of American Railroads, total US regular carload traffic for the first half of 2016 was down 12.3% year over year, while volumes in the once high flying intermodal sector were actually down 2.1% percent in the quarter. That left total rail traffic volume in 1H at about 13 million carload and intermodal units, down 7.4% from the same point last year.

Separately, the Intermodal Association of North America (IANA) just reported that intermodal volumes were lower year over year in Q2 for the first time in 25 quarters, or a little more than six years.

Total carloads in the quarter were weak for all four carriers, down 9-11% for all but Kansas City Southern, which was flat. That's in part because KCS' coal volumes were down just 1%, versus 21-31% for the other three carriers, as the brutal decline in that market continues on. But "general merchandise" volumes - which includes everything from autos to consumer products and chemicals - were weak as well, down 3-5% again at all but Kansas City Southern, where they were up 3.1%

Naturally enough, those lower volumes led to declining revenues, down 11% across the four carriers, though part of that decline was also caused by lower diesel prices one again year over year.

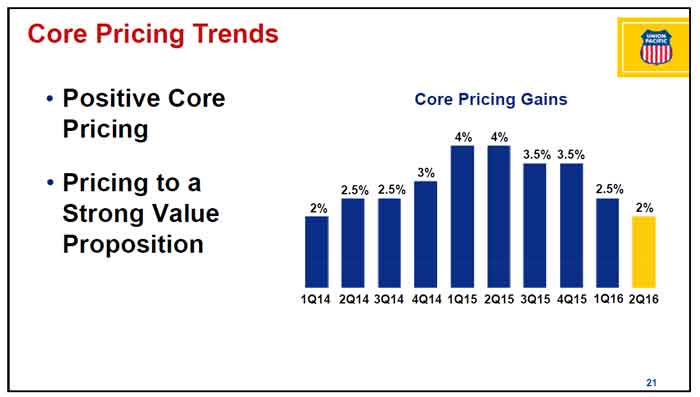

But despite those sluggish volumes, several of the rail carriers indicated they were able to increase rates modestly in Q2. Union Pacific said rates were up 2.0% in Q2, for example, though that is down from previous quarters, as shown in the chart below.

Core Pricing Gains were Down at Union

Pacific in Q2, but Still Positive in Weak Market

CSX said overall rates were up 2.9% in the quarter.

Net income was down 15.3% for the group, led by CSX, where profits fell 19.5%, and Union Pacific (down 18.7%). Norfolk Southern saw net income fall just 6.5%, while profits in Q2 were actually up 7.4% at KCS.

Net income as a percent of revenue for the group fell a bit, to 18.6% from 19.5% in Q2 2015. That metric at Kansas City Southern was an impressive 21.2% and 20.5% at Union Pacific. Compare that to an average of just 6.4% for our truckload carrier group, and 12.1% at consumer products giant Procter & Gamble in Q2.

Relatedly, average operating ratios (OR), or operating expense divided by operating revenue, a key metric in the transport sector, were up actually down in Q2 to 66.0% (unweighted average) from 67.3% in 2015, led by a 7 percentage point drop at Kansas City Southern.

That level of OR is of course far superior to that seen in the truckload or LTL sectors, which generally see ORs in the high 80 percent levels and low 90 levels, respectively. For exmple, in Q2, our group of publicly traded truckload carriers saw average operating ratios of 88.7%.

Full Q2 financial results for our group of rail carriers is shown below:

Q2 2016 US Rail Carrier Operating Results

(See More Below)

|

CATEGORY SPONSOR: SOFTEON |

|

|

| |

|

|

As usual, we provide a few highlights from the earnings releases of each carrier, though they were even more terse in Q2 than usual.

Union Pacific

"A soft global economy, the negative impact of the strong U.S. dollar on exports, and relatively weak demand for consumer goods will continue to pressure volumes through the second half of the year," the company said.

Core pricing was up 2% in the quarter.

Quarterly train speed, as reported to the Association of American Railroads, was 26.6 mph, 8% faster than the second quarter 2015.

UP said it maintains a full year operating ratio target of 60% by 2019.

CSX

Company said it was a "challenging market, which is expected to persist throughout this year."

Said it saw "pricing gains" in the quarter, with rates up 2.9% overall and 4.0% for merchandise and intermodal.

Also said it was committed to achieving a mid-60s operating ratio longer term, versus 68.9% in Q2.

Norfolk Southern

Company said that "We are on track to achieve productivity savings of at least $200 million for 2016, and our record first half operating ratio of 69.4% gives us confidence we'll achieve a full-year operating ratio below 70%."

Its OR in Q2 was 68.6%, an improvement of 14 percentage points compared with 70.0% in the second quarter of last year.

Kansas City Southern

Company said it saw "positive volume trend experienced during late May and the entire month of June."

KCS achieved an impressive 0perating ratio of 61.3%, compared with 68.1% in second quarter 2015.

Any reaction to the Q2 results and trends from the rail carriers? Let us know your thoughts at the Feedback section below.

Your Comments/Feedback

|