From SCDigest's On-Target E-Magazine

- Dec. 15, 2015 -

Supply Chain News: US Manufacturers Reasonably Bullish on 2016 Despite Recent Slow Down

ISM Panel on Average Expects Top Line Growth of 4.1%, versus Increase of Just 1.4% in 2015

SCDigest Editorial Staff

US manufacturers expect their revenues to grow a solid 4.1% in 2016 - even as the data right now show things largely moving in the other direction. That compares to expectations for an increase in revenues of 1.4% for 2015.

SCDigest Says: |

|

A strong dollar tends to have a negative impact on profits for companies with a substantial international business, as the profits earned abroad in local currencies are worth less when translated back into US dollars. |

|

What Do You Say?

|

|

|

|

That and many other projections come from the semi-annual business forecast issued by the Business Survey Committee of the Institute for Supply Management (ISM), the same group that publishes the well-known Purchasing Managers Index each month.

63% of survey respondents expect revenues to be greater in 2016 than in 2015, and 16 of the 18 industry sectors ISM tracks also predict positive revenue growth next year.

The bullish 4.1% growth forecast on average across the panel comes even as the US manufacturing sector has slowed significantly of late even by its own measure.

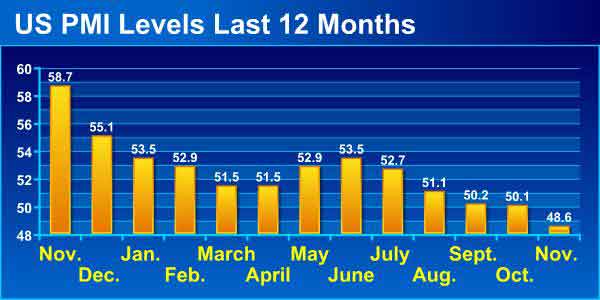

The December PMI, for example, fell below the 50 mark that separates expansion from contraction in November for the first time in 35 months, at a score of 48.6. That followed two months where the index was barely above the 50 level, and was the worst PMI reading since June, 2009, at the very bottom of the recession. (See graphic below).

That put the average PMI of 51.7 for the first 11 months of 2015, several percentage points lower than the 2014 average and not much above the 50 mark.

Manufacturing activity as measured by the Federal Reserve has also flatlined in recent months, with US manufacturing output up just 1.9% year over year in October, the most recent month for which we have data, continuing a trend seen for the past six months.

Despite the strong revenue projections, the ISM panel doesn't expect much in the way of capital expenditures. The panel on average expects CapEx will increase by a modest 1% in 2016 over 2015, compared to the strong 8.3% increase reported for 2015.

The top line growth won't help much on the jobs front either, with the manufacturing panel predicting employment at their companies to just barely grow, at 0.2%.

Manufacturing purchasing and supply executives also report their companies are currently operating at 81.6% of normal capacity. This is a moderate increase when compared to April 2015 (79.5% utilization), and a moderate decrease when compared to December 2014 (83.7%).

(Manufacturing Article Continued Below)

|