From SCDigest's On-Target e-Magazine

March 7, 2012

Supply Chain News: New Procurement Report from KPMG Finds - as Usual - Profession Needs to Expand Scope, Move Up the Food Chain

Survey Also Finds a Lot of Room for Process Maturity Growth in Most Industries

SDigest Editorial Staff

A new report from the consultants at KPMG finds, as seems almost always to be the case in procurement-related studies, that the profession needs to expand its focus beyond cost cutting and negotiations to be more full members and even leaders of the supply chain team, and drive towards a more total cost management perspective.

It's probably true, but it seems virtually every study in this area comes back with the same data and conclusions; the industry needs one that is more focused on how to get there.

SCDigest Says: |

|

Consumer goods and general manufacturing, on the other hand, reported that only about 20% of respondents said that direct spend was 100% managed by central procurement.

|

|

What Do You Say?

|

|

|

|

The report was based on survey data from nearly 600 supply management professionals, primarily from Europe. From a supply chain perspective, the data is a little muddled because it includes lots of responses from sources in government, non-profit organizations , healthcare and other sectors somewhat outside of what is normally considered supply chain oriented firms, but the work looking at nevertheless.

The introduction notes that "many executives are increasingly looking to procurement to engage the business in strategic conversations about how the supply chain can be optimized to deliver the greatest returns. But, overwhelmingly, procurement has been slow to evolve. Our research shows that – across the board – there is not enough focus on ongoing supplier relationship management, precious little involvement in demand management, even less participation in the ‘make versus buy’ decision process and an often dangerous lack of preparation, mitigation and action around supply chain risk."

In turn, it suggests there are five areas where the procurement function can really step up its game:

Partnering within the Organization: Supply managers need to get more understanding of and alignment with various business interests within their companies. That means moving up the value chain, getting involved earlier in the decision-making process - and demonstrating there is real value from doing so.

Moving Beyond Cost Savings: While driving costs out of supply will always be a core value from procurement, supply managers need to capabilities such as category management, and beyond into demand management, Supplier Relationship Management (SRM) and risk management.

Achieving the Optimal Operating Model: While many companies have more centralized the procurement function, it is not clear that this is really translating into strategic value for many of them. Many companies are or should be reassessing their operating models to squeeze greater value from their activities around the world.

Prioritizing Supply Chain Risk: Despite all the disruptions from natural disasters, the financial crisis, etc., the research demonstrates a worrying lack of leadership in the area of supplier risk, according to KPMG.

Leveraging Systems and Technology: Despite lots of powerful new technology, many companies just won't invest - or are failing to get all they could from existing investments.

How Much of Spend Does Procurement Control?

Who really controls the spending? That is one of the key questions that is always asked in these types of surveys, and if you are of a mind that procurement should control nearly all of it, you will be at least partially disappointed with the survey results.

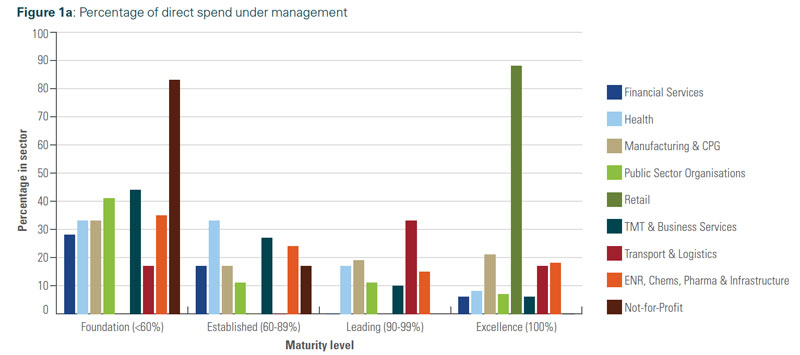

The chart below indicates the percent of "direct spend" - spending for goods that are used for production or resale (raw materials, components, finished goods for resale, etc.) by various level of procurement achivement and different industry sectors.

Source: KPMG

As can be seen, only retail really stood out, with almost 90% of respondents saying that 100% of direct spend occurs through procurement - a level that KPMG defines as being necessary for "excellent" in this area.

Consumer goods and general manufacturing, on the other hand, reported that only about 20% of respondents said that direct spend was 100% managed by central procurement, and the highest percentage of manufacturing respondents (just over 30%) was actually in the lowest level (foundational), with less than 60% centrally managed.

Moreover, the report notes that most companies outside of the retail sector indicated that less than three-quarters of even their direct spend is currently managed under contract.

(Sourcing and Procurement Article Continues Below) |