From SCDigest's On-Target E-Magazine

March 7 , 2012

Logistics News: Rail Carriers Enjoy Another Strong Quarter and Year, as LTLs Make Progress

Rail Carriers Once Again Show Strong Profit Growth with Modest Volume Gains; a Little More Black Showing Up in LTL Segment, Our Exclusive Analysis Shows

SCDigest Editorial Staff

We continue to say Warren Buffet made a very smart move when his Berkshire Hathaway aquired Burlington Northern Santa Fe a couple of years ago, as rail carrier profits and pricing power continue to be strong even amidst tepid volume growth.

SCDigest Says: |

|

| Norfolk Southern said that it will continue to make "substantial investments along our Crescent Corridor, a public-private partnership to create a high-capacity, truck-competitive intermodal freight rail route between the Gulf Coast and Northeast." |

|

What Do You Say?

|

|

|

|

Once again, SCDigest has analyzed the financial results and market comments released near the end of January into early February from a number of leading publicly traded rail and LTL carriers announcing results for Q4 2011 and the full year.

Last week, we looked at the results from eight leading truckload carriers, which can be found here: Truckload Carriers Again Enjoy a Solid Q4 and Full 2011, Our Exclusive Analysis Shows.

As shown in the charts below, the four major public US rail carriers kept their profit engines running again in Q4 and for the full year of 2011, with revenue among the group up 14.5% on average, even though car load volumes were up only in the low to mid-single digit percentages for each of them.

Some of this can certainly be attributable to fuel surchage increases, but clearly pricing power and rates also played a key role.

For example, CSX noted in its earnings call that of the $306 million increase it had in fourth quarter revenue, just $51 million was attributable to higher volumes. while $117 million came from higher fuel surcharge revenue, as diesel prices soared. But about 45% of the reveenue increase, or $138 million, came from higher rates and improved "mix," a euphanism of sorts being able to select more profitable freight to haul.

The result was strong profit growth for most in the quarter as well, though CSX and Norfolk Southern saw some deceleraion in profitability versus recent quarters. Union Pacific profits were up 23.9% in the quarter, and Kansas City Southern's rose 72.7% over a poor Q4 in 2010.

Rail Carriers Q4 1011

View Full Size Image

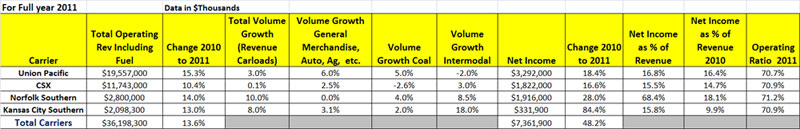

The story was much the same for the full year, with the carriers showing a 13.6% average gain in revenue on volume growth that averaged about 5%. The lowest growth in net income for the year was from CSX, which still managed to grow the bottom line more than 16%.

Operating ratios, or the percent of operating expense versus operating revenue, continue to fall for the carriers, which of course has a direct link to overall profitability. All four of carriers have OR down to near 70%, with Union Pacific noting that its "operating ratio of 68.3% was a fourth quarter best, 1.9 points better than the previous fourth quarter record set in 2010. Pricing gains, volume growth and improved operating efficiency contributed to this record performance, more than offsetting the negative impact of higher diesel fuel prices compared to 2010."

CSX said that it "remains committed to achieving a 65 percent operating ratio by no later than 2015."

Meanwhile Norfolk Southern said that it will continue to make "substantial investments along our Crescent Corridor, a public-private partnership to create a high-capacity, truck-competitive intermodal freight rail route between the Gulf Coast and Northeast,” saying that it will open intermodal terminals in Alabama, Pennsylvania, and Tennessee later in the year.

Rail Carriers Full 1011

View Larger Image

(Transportation Management Article Continued Below)

|