SCDigest

Editorial Staff

SCDigest Says: |

The report notes that “the spot market typically leads contractual pricing both up and down, although contractual rate increases are seemingly taking longer to develop than initially expected." The report notes that “the spot market typically leads contractual pricing both up and down, although contractual rate increases are seemingly taking longer to develop than initially expected."

Click Here to See Reader Feedback

|

The State of the Freight Report from the newly renamed Wolfe, Trahan & Co. (formerly Wolfe Research, with this quarterly report dating back to Ed Wolfe’s days as a transportation sector analyst for Bean Sterns before its collapse) for the second quarter has just been released, with shippers definitely seeing supply and demand in the transport markets finally starting to swing back somewhat towards carriers.

Every quarter, Wolfe Trahan receives survey responses from approximately two hundreds shippers representing tens of billions in freight spend. In the end, the analysis is geared towards stock picking in the transport sector, but contains many data points that are of interest to shippers and logistics professionals as well.

In the Q2 2010 report, Wolfe Trahan sees further signs that volumes and rates are continuing to rise amid the wobbly economic recovery. On average, for example, shippers expect their overall transportation budgets for the next 12 months to rise 5.3% (that would include both volume, rate and fuel surcharge increases), up from 3.1% expected in Q1 and an amazing 12% decline that was expected over the next year in the Q2 2009 report.

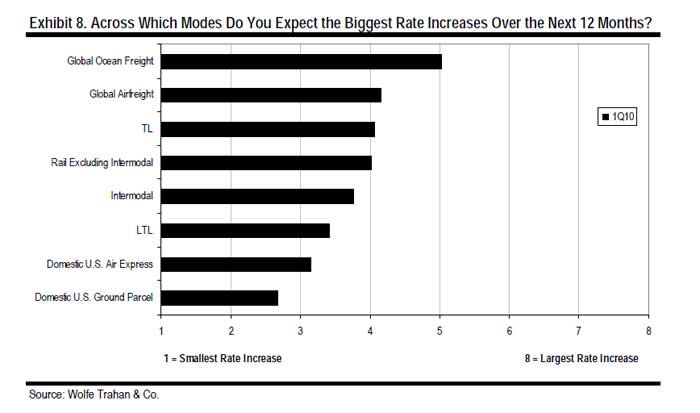

As they see volumes rising and capacity staying down, most shippers are also expecting to see rate hikes across almost every mode. As shown in the figure below, those expectations are led by predictions for the highest rate increases for ocean shipping, with global airfreight, truckload carriage and regular rail all not far behind. Wolfe notes that ocean spot rates are up about 100% versus this time in 2009.

Not surprisingly given these expectations, shippers also see capacity continuing to tighten in the US truckload market. The report says that for the first time in nearly two years, fewer than 50% of respondents saw overcapacity in the TL sector. Additionally, 75% of shippers expect that capacity to tighten further over the next year, the highest percentage since 2004.

While contract rail rates are expected to rise about 3% over the next 12 months, up from predictions for a 1.9% increase in Q1, rail service is seen as slipping.

(Transportation Management Article - Continued Below)

|