| SCDigest Says: |

The driver seems to be retail compliance – or most likely Walmart compliance – as 83% cited trading partner “requests” as the main driver of activity The driver seems to be retail compliance – or most likely Walmart compliance – as 83% cited trading partner “requests” as the main driver of activity

Click Here to See Reader Feedback |

EPCGlobal, an arm of the GS1 organization that focuses on the electronic product code (EPC) form of RFID, has just released a study that shows bullish signs from consumer goods manufacturers on EPC, but in our view the study leaves as many questions as it answers.

“Perceptions about Electronic Product Code (EPC)-enabled RFID technology are changing much more slowly than reality,” the report says upfront, contending that the general belief that EPC in the consumer goods-to-retail supply chain is largely stagnant doesn’t square with reality, based on the survey data.

The survey was executed in the first quarter of 2009 – meaning the data is a year old. It is not clear why the long delay from survey to report, but that might have some impact on user responses, as Walmart and its Sam’s Club division both lost momentum on their RFID programs during 2009 - meaning answers right now might be different than a year ago.

For example, the survey found that 83% of respondents were involved in EPC because of a trading partner request. As almost no other US retailer has required EPC tagging in the US except for Walmart, and Walmart is not now enforcing its previous mandates, it is still not clear what is happening with EPC at the manufacturing level.

Surveys were sent to 600 EPCGlobal member companies. The report does not say how many responses were received. Howver, an EPCGlobal spokesperson confirmed there were 60 respondents. (To download the full EPCGlobal report, go to: Report on the 2009 EPC/RFID Tagging Survey for the Retail / CPG Supply Chain

RFID Costs and Performance Increasingly Not Barriers

“RFID technology enabled by the EPC is reliable, suitable for adoption by companies of all sizes - and affordability is no longer considered a major obstacle, according to the majority of respondents,” the report states.

These “historical obstacles to EPC-enabled RFID adoption are weakening and disappearing,” it adds.

That view is supported by an analyst at market research firm VDC Research, who recently wrote that “The price-performance tradeoff continues to improve, especially for the EPC Gen2 market, continually lowering the cost justification points… a trend expected to continue for several more years.”

We agree that the overall trends in price and performance continue to improve, but haven’t seen the evidence, primarily for case-level tagging, that the framework developed by Procter & Gamble and others that classifies products as being “Advantaged”, “Testable” and “Challenged” for RFID tagging - based on ROI which in turn implies cost factors - is no longer still valid. The report argues that framework is increasingly losing relevance.

Pallet tagging is a different matter, as the costs of tagging relative to product value and benefits are often very low. (See excellent Supply Chain Videocast: The ROI for RFID in Distribution: It is There!)

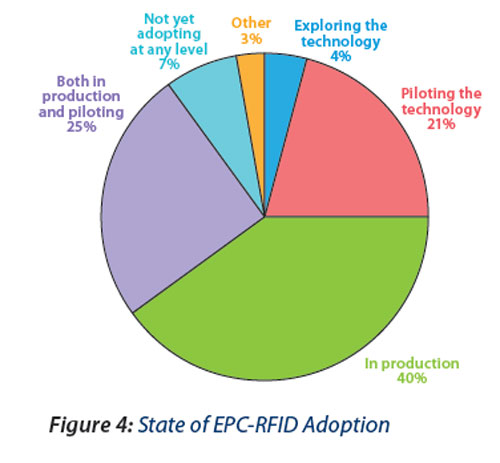

The survey found 65 percent of respondents are in production with EPC technology, and an additional 21 percent are piloting. Only 7 percent were not adopting the technology at any level, a shown in the graphic below.

Source: EPCGlobal Report

As noted above, the driver seems to be retail compliance – or most likely Walmart compliance – as 83% cited trading partner “requests” as the main driver of activity. 11 percent of respondents cited “Better Supply Chain Management” as the driving force for EPC adoption. That number is not very high – though we would actually predict, given the tail off in Walmart’s program and the overall evolution of RFID, that the percent both of companies piloting RFID in some way and seeing the driver as operational improvement, not compliance, would be higher right now than at this time last year.

(RFID and Automatic Identification Article - Continued Below)

|