| |

|

| |

|

|

Supply

Chain by the Numbers |

| |

|

| |

- Oct. 21, 2016 -

|

| |

|

| |

|

| |

|

| |

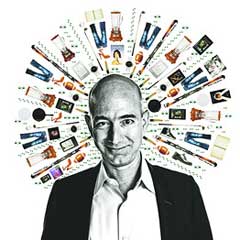

Amazon's On-Line Share is Even Bigger than We Thought; US Truckload and Intermodal Rates Down Yet Again; Container Shipping Industry May have Hit Bottom; Drones Take Yard Inventories in Minutes |

| |

|

| |

| |

| |

30% |

|

|

|

| |

| |

|

3.5%

|

|

That was the level of year-over-year decrease in US truckload rates in September, according to the just released Cass Linehaul Price Index for the month. That makes it seven consecutive months of year-over-year rate declines, as a weak freight environment continues to take its toll on carriers. Cass also cites carrier bankruptcies at historic lows, truck counts up by single digit percentages, and the relaxation of the 34-hour restart rule as contributing to the continued shift in the supply-demand balance in shippers' favor. The last time the market saw seven months or more of rate declines was in the recession year of 2009. Meanwhile, the Cass Intermodal Price Index fell in September for an amazing 21st consecutive month. |

| |

| |

|

| |

| |

30 |

|

That's about how long it takes to execute a complete inventory of what trailers are stored in a large outdoor yard using drone technology and RFID tags on trailers. That according to Matt Yearling, CEO of PINC Systems, during a presentation at the MHI annual conference this week in Tucson, AZ, noting such drones can fly in crosswinds at some 40 miles per hour. While such a drone-based system for yard management generally only makes sense for large yards with densely stored trailers, there are many other distribution center-oriented applications that can benefit from drone technology, Yearling said. That includes taking physical inventories in large outdoor warehouse areas ("lay down yards"), and taking physical inventories inside the DC, an application Walmart has said it is testing. In that app, a drone flies the aisles (usually during off-shifts), using imaging systems to read location labels and license plate bar codes on stored pallets. This takes just a fraction of the time it does to use humans to take such inventories, allowing some companies to execute the process every day, Yearling noted. He added that 100% inventory accuracy can be achieved from the technology n pallet storage areas. However, work still needs to be done on technology to determine the number of cases stored on partial pallets. |

| |

| |

|

|

|

| |

|

|

| |

|

|

| |