| |

|

| |

|

|

Supply

Chain by the Numbers |

| |

|

| |

- March 8 , 2012

|

| |

|

| |

|

| |

|

| |

Toyota Maps Half its Supply Chain; Truckload Rates Keep Climbing; Global Manufacturing Holding On; A Hiring Bounty for Welders and more

|

| |

|

| |

| |

| |

|

|

$2500 |

The "bounty" that Mazak Corp. of Florence, KY is currently offering to new welders that join the machine tools manufacturer, as despite high levels of overall unemployment many manufacturing jobs in more skilled positions go unfilled. Mazak is having a very hard time hiring for the 20 welding positions it has open. It is far from the only US company in this boat. According to the Bureau of Labor Statistics, there were 264,000 job openings in the manufacturing sector at the end of last year, compared with approximately 100,000 two years ago, with most of these in more skilled positions.

|

| |

| |

|

| |

| |

| |

|

|

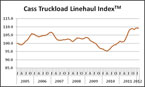

Percent by which per mile truckload rates were up in February over the same month in 2011, according to the latest Truckload Linehaul Index report from Cass Freight Systems. The 109.1 level in February was down slightly from January’s all-time high of 109.4, based on the index of 100 set at the beginning of 2005. The index reached a bottom with a score of about 95 in late summer 2010, meaning rates are up about 15% since that time (109.1/95). It has really been a diagonal path straight up from the bottom, and that's before higher fuel surcharges.

|

| |

| |

| |

|

|

|

| |

|

|

| |

|

|

| |