|

In December, more than 300 SCDigest readers participated in our annual supply chain study in partnership with the analysts at Gartner.

Gilmore Says: |

Klappich also called out that the survey showed that companies realize they need to improve in terms of their supply chain innovation performance. Klappich also called out that the survey showed that companies realize they need to improve in terms of their supply chain innovation performance.

Click Here to See

Reader Feedback |

There were some very interesting results this year. I can’t make the entire result set available (that’s reserved for Garter clients), but I am able do a pretty good job of summarizing several of the key points. That will include some comments on the survey results from Gartner’s Dwight Klappich, who along with fellow analyst Charles Eschinger led the analysis of the data. The main theme this year: supply chain is switching from defense to offense.

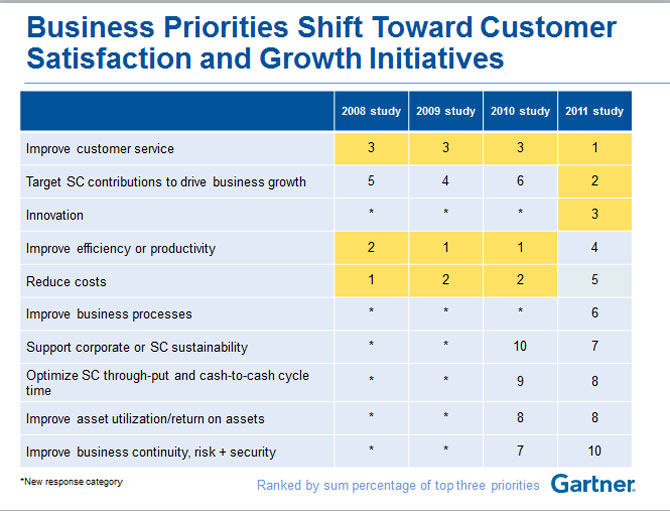

In the last couple of years, there has been a subtle but important change in terms of how companies rate their supply chain priorities. Specifically, in 2010 and 2011, “improving productivity” swapped places with “reduce costs” as the most important supply chain objective. The thesis was that companies were focused on getting back on a growth mode, after having cut costs to the bone during the financial crises, with the goal of getting back to where they were but with needing fewer people.

Well, even that change has been turned on its head in 2012, as shown in the graphic below. Amazingly, a series of more growth oriented priorities dominated the list. Improving customer service, using the supply chain to drive the top line, and increasing supply chain innovation came in ranked 1, 2 and 3 respectively, (to the somewhat surprise of all of us) in 2012.

Klappich was especially intrigued with the high place innovation reached in this year’s results.

“I think most companies realize that they have cut about as much as they can from supply chain staff and operations,” Klappich told me this week. “Supply chain innovation has been out there for a while but frankly it has been kind of an empty concept. But now, companies are looking for innovation that drives new routes to market to increase sales.”

That in fact is exactly what Procter & Gamble’s supply chain exec Jake Barr said at the CSCMP conference I believe in 2010, where he said P&G supply chain organization had specific targets (something like $2 billion annually) for driving revenue growth through enabling the company to open new markets.

Klappich added that “Companies realize that it really isn’t business as usual. Companies and their supply chains need to change the way they do business,” citing as the obvious key example what retailers and some consumer goods companies are doing in the area of multi-channel commerce. Macy’s major supply chain focus right now, for instance, doesn’t appear to be about reducing costs, but rather making major investments in changing stores, processes, and technology to significantly change its capabilities to fulfill multi-channel orders flexibly and accurately across its network (including using stores themselves as fulfillment centers).

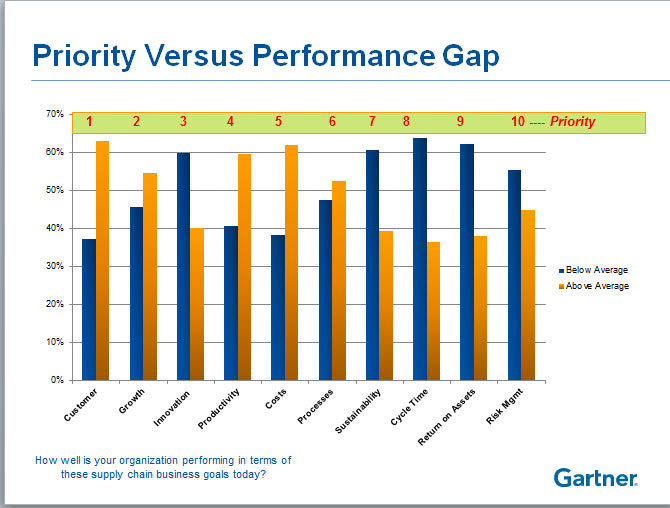

Klappich also called out that the survey showed that companies realize they need to improve in terms of their supply chain innovation performance.

The chart below shows how companies rate themselves in terms of a number of supply chain attributes versus how they thing others are doing. Note that 60% believe they are below average in terms of supply chain innovation, versus 40% that believe they are above average in innovation.

Another important change from the results in previous years of the study was that the trend of companies blaming their supply chain woes on a lack of forecast accuracy and related demand volatility seems to be fading a bit versus other factors.

Forecast accuracy was still rated as the top obstacle to supply chain success, but the percent citing that was down from 2011 and even more from earlier years of the study. Meanwhile factors such as the challenges of synchronizing end to end processes, lack of visibility, and supply chain complexity continued to see higher scores in terms of supply chain success obstacles versus previous years.

I am glad to see that. To blame supply chain woes on forecast accuracy has always seemed to me a cheap way out (“let’s blame the demand planners”), especially given that it is almost an axiom that all forecasts will be wrong.

Klappich said he sees attitudes changing relative to challenges especially as related to supply chain complexity.

“The leaders are recognizing that it is very difficult to reduce complexity, that you need to change your mind set to better managing the inherent supply chain complexity today,” he told me.

He also said that companies really are focused on cutting down the siloes across function groups in the supply chain to better align end to end processes.

“I have described how many companies are still disconnected in their supply chains as resembling a rugby team in which no one speaks the same language,” Klappich said. “Individual team members can be very aggressive, but there is a noticeable lack of coordination on the field.”

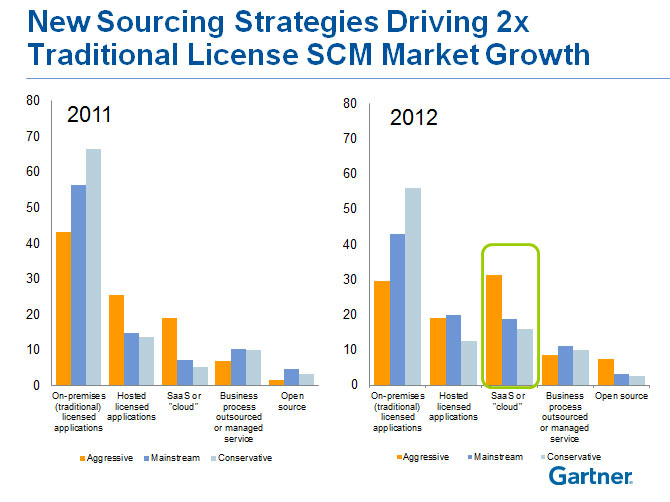

Finally, as I have been predicted for some time now, this year’s results show growing interest in on-demand/cloud-based solutions. As shown in the graphic below, interest in cloud solutions jumped substantially in this survey versus 2011. And Klappich pointed out to me that the key observation is that this isn’t just for conservative or smaller firms that might look to the cloud to get software at a lower investment level, but just as much if not more for “aggressive” adopters of supply chain technology and larger companies (the orange bar).

Ok, that’s all I have room for. If you are a Gartner client, this research will be released across a variety of vehicles in coming weeks. If not, well…if you send me an email I might be able to help.

Please consider participating in the 2013 survey towards the end of the year.

Any reactions to this year’s Gartner study? Are you surprised growth related priorities rose to the top of the list? Let us know your thoughts at the Feedback button below.

|